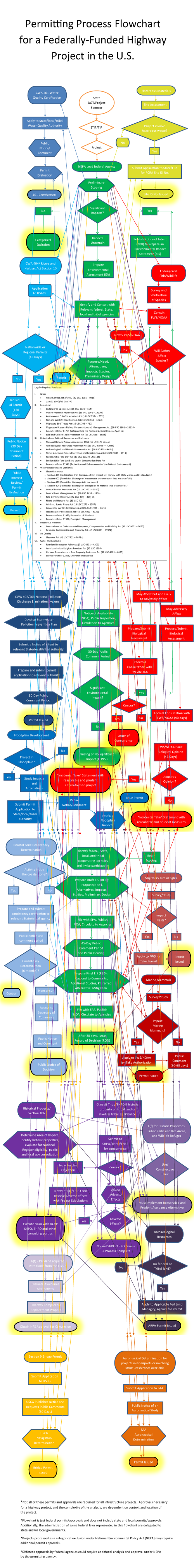

President Trump signed an infrastructure permitting executive order on Tuesday, the intended highlight of that day’s news conference. The executive order is part of the White House’s “Infrastructure Week,” and has the goal of expediting permitting for infrastructure projects by requiring each project to have a lead federal agency in charge of navigating it through the bureaucracy, and directing federal agencies to determine ways to reduce average permitting time from seven years to two years. President Trump and Secretary Chao displayed a flowchart of the existing federal permitting process, which I’ve pasted at the bottom of this post. The executive order also revoked a flood control planning process relating to global warming mitigation.

As for a tangible plan, the focus so far has been more on financing than actual funds. During the campaign, Trump frequently mentioned a $1 trillion infrastructure plan, several times the $250 billion plan Hillary Clinton had proposed. But both plans focused on financing, not funding: Clinton proposed $25 billion in seed funding for a “bank” that would somehow turn that into $250 billion of projects. Trump’s proposal was originally $137 billion in generous 82 percent tax credits to private investors if they invested $167 billion into constructing $1 trillion worth of projects, meaning it could only go toward projects that could earn the cash to recoup the investment. An updated proposal, included in the President’s budget request, relies on a mix of $200 billion in tax credits and direct funds, although only $5 billion was requested for the 2018 budget and the new spending is offset by $95 billion of proposed cuts to highway and transit projects. At the same time President Trump has needled Senate Majority Leader McConnell to put a plan on his desk, his team has noted low federal borrowing costs, and this spring White House officials listened to a pitch covering 500 potential infrastructure projects from across the country.

It’s worth noting most infrastructure is funded, built, and owned by private actors, not public ones. In 2015, $2.3 trillion was spent building private infrastructure in the U.S., including pipelines, power stations, refineries, freight railroads, cell phone and broadband networks, and factories. That was about five times the size of public infrastructure spending that same year of $472 billion, split about $192 billion by the federal government and $280 billion by state and local governments. Most of that (about one-third) was for highways, with the rest primarily water utilities, mass transit, schools, and passenger rail. Most of the federal money was for new projects; most of the state and local money was for operations or maintenance of infrastructure. Unless we’re talking about spending much more money than either Clinton or Trump ever proposed, the biggest bang for the buck will be reducing obstacles in the way of private infrastructure builders.

Do we need more infrastructure? Most everyone seems to think so: the American Society of Civil Engineers (ASCE), a not-disinterested bunch, gives the U.S. a D+ grade and estimates the country needs $4.59 trillion in infrastructure between now and 2025, of which $2.06 trillion is unfunded. Hardly a week goes by without a prominent person comparing the state of U.S. airports or passenger rail to gleaming European or Asian ones. Then there are the 58,791 American bridges categorized as structurally deficient, but that’s out of a total of 611,845. Rail and road systems are visibly in trouble, but the privately-managed freight network got the highest grade the ASCE gave (B) and state highways paid by dedicated user taxes and user fees seem in better condition compared to other transportation infrastructure more dependent on appropriations.

So maybe the focus should be on how to get operators more of an ownership stake and find a way for users to pay for what they use. Steps to do so with the woeful air traffic control system have begun, and perennial proposals regarding the U.S. Postal Service, the Tennessee Valley Authority, Amtrak, interstate toll roads, and federally-owned lands and dams may need dusting off.

For that infrastructure that needs public funding, how should we pay for it? The federal gasoline taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. has been fixed at 18.4 cents per gallon since 1993; since then, construction costs have doubled while cars are getting increasingly more miles per gallon. In FY 2017, the federal highway trust fund collected $41 billion in gasoline and other user taxes but spent $54 billion. This imbalance continues to worsen; the CBO estimates that by 2027, the fund will collect $40 billion and spend $63 billion. The choices are cutting spending, raising revenue, or bailing out the fund with other tax revenue (as Congress has now done on several occasions). States, confronted with the same dilemma, have opted for raising revenue, both through higher gas taxes and through more user charges like tolls and vehicle miles traveled taxes. Earlier this year, we estimated the economic impact of additional infrastructure spending and found that it really depends on how you pay for it: funding $500 billion of infrastructure spending with gas taxes or user fees increases GDP by 0.06 percent, while funding it with higher business taxes reduces GDP by 0.41 percent. Deficit-financing it boosts GDP by 0.11 percent, although that obviously has the larger impact on the budget deficit.

One last note on infrastructure, or at least the word itself. The word appeared in France in 1875 to describe railways and occasionally appeared in dictionaries afterward, but only gained common usage after World War II when NATO used the term to reference installations necessary for the defense of western Europe. Winston Churchill, then leader of the opposition to the 1945-51 Labour government, mocked the increasing use of the term as superfluous: “In this Debate, we have had the usual jargon about ‘the infrastructure of a supra-national authority.’ The original authorship is obscure; but it may well be that these words ‘infra’ and ‘supra’ have been introduced into our current parlance by the band of intellectual highbrows who are naturally anxious to impress British labour with the fact that they learned Latin at Winchester.” In D.C. parlance one rarely hears “infrastructure” without “our nation’s crumbling” preceding it. More kind is a mantra of Mark Zuckerberg’s: “move fast with stable infrastructure.”