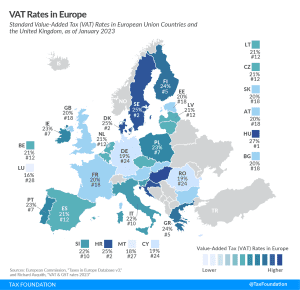

VAT Rates in Europe, 2024

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

In such a determinant semester for Europe, principled tax policy can be an important tool for a more competitive European Union.

5 min read

While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT actionable policy gap is 15.65 percent, more than triple the compliance gap.

5 min read

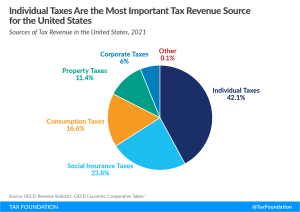

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

The Portuguese government has introduced plans to exempt “essential” food items from its value-added tax (VAT) in response to the recent inflation spike. While this may sound like a reasonable measure on the surface, it comes with numerous unintended consequences that compromise its effectiveness.

4 min read

Spain should follow the examples of Italy and the UK and enact tax reforms that have the potential to stimulate economic activity by supporting private investment while increasing its international tax competitiveness.

7 min read

As Chile looks to the future, policymakers might want to follow the UK’s example. Policymakers should focus on growth-oriented tax policies that encourage private and foreign direct investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

2 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read