OECD Report: Tax Revenue as a Percent of GDP in Latin American and Caribbean Countries Is below the OECD Average

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

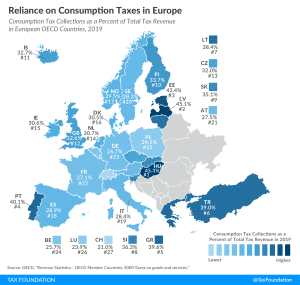

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

The UK’s Chancellor of the Exchequer Rishi Sunak released the 2021 budget, and most important for near-term growth is the significant boost to capital allowances.

5 min read

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

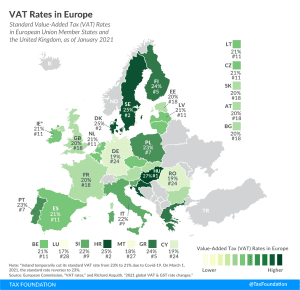

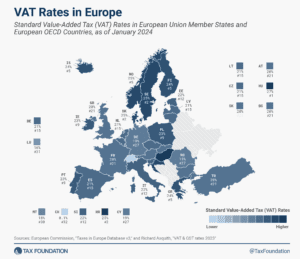

Many governments have chosen to use VAT as a tool to provide tax relief for consumption in various sectors throughout the pandemic, but in the long term, VAT should not be used as a tool for relief.

3 min read

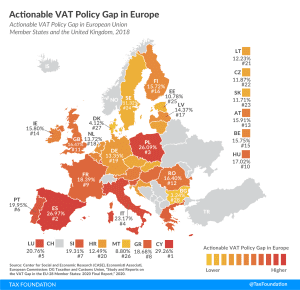

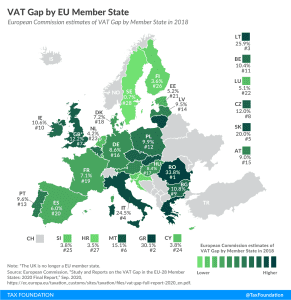

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

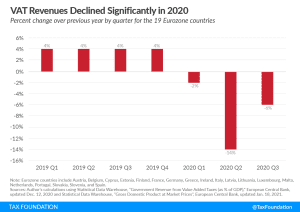

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

Tax policy responses to the pandemic should be designed to provide immediate support while paving the way to recovery. A temporary VAT rate cut in the context of an inefficient VAT system is likely to deliver mixed results at best.

4 min read

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

Learn about how taxes can influence human behavior through the power of incentives. See how different tax policies have impacted everything around us, including the buildings we live in, the cars we drive, and even what we eat and wear. Gain a deeper appreciation for the importance of designing tax policies that encourage positive economic behaviors.

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.