Colombia Is in Urgent Need of Pro-Growth Comprehensive Tax Reform

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

West Virginia Amendment 2 would not directly reduce tangible personal property taxes—on cars, inventory, or machinery and equipment. It would, however, empower the legislature to consider such reforms.

4 min read

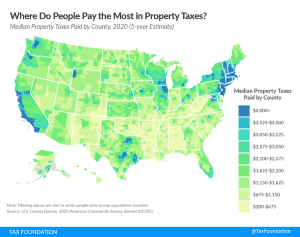

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

While Wisconsin has long been one of the highest-tax states in the nation, that distinction is increasingly detrimental as businesses and individuals enjoy increased economic and geographic mobility.

6 min read

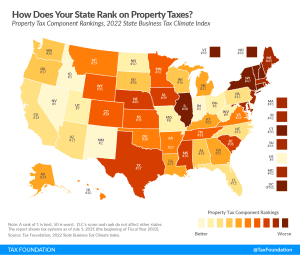

Property taxes are highly unpopular and can get extremely confusing. But when done right, they can be quite good. We talk through what a well structured property tax should look like, which states have good property tax structures in place and which ones don’t, and how these taxes impact a state’s competitiveness in an increasingly mobile economy.

Which states have the highest property taxes in 2022? See how your state compares in property taxes across the United States

5 min read

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.

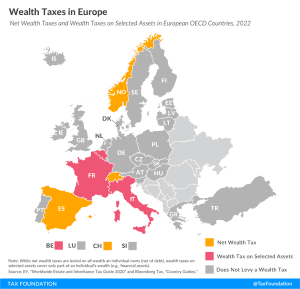

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

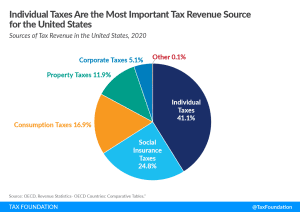

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min readDesigning tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read