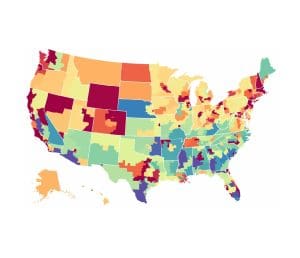

Overview of the Tax Foundation’s General Equilibrium Model

The Tax Foundation uses and maintains a General Equilibrium Model, known as our Taxes and Growth (TAG) Model to simulate the effects of government tax and spending policies on the economy and on government revenues and budgets.

9 min read