Kansans May Finally Get a Low, Flat Income Tax

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

5 min read

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

5 min read

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

The individual income tax has plenty of problems, but in some respects the tax has improved in recent decades. Unfortunately, several Trump administration proposals would move us in the wrong direction, including the president’s call to drop taxes on tips.

With a wealth tax, property tax increases, and this new payroll tax on the agenda, Washington lawmakers have reason to fear that many employers could be looking for the exits.

5 min read

This legislative session, local taxes are a major topic of debate in Indiana. Although the state’s property tax system is already nationally competitive, dramatic increases in assessed values have created discontent in recent years.

8 min read

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

A North Carolina House bill titled “No Tax on Tips, Overtime, Bonus Pay,” is gaining bipartisan traction in the General Assembly, mirroring similar proposals nationwide, including those championed by President Trump.

4 min read

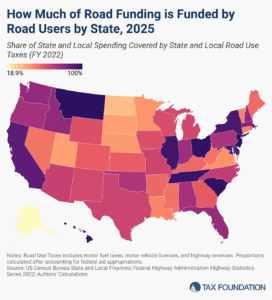

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

A recent proposal in Minnesota exempting certain nonresident workers from having to file and pay income taxes would reduce compliance costs for business travelers and their employers at limited cost to the state.

4 min read

With property tax bills on the rise, homeowners are searching for answers—and some even want to abolish the tax altogether. In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source.

The Tax Foundation uses and maintains a General Equilibrium Model, known as our Taxes and Growth (TAG) Model to simulate the effects of government tax and spending policies on the economy and on government revenues and budgets.

9 min read

While capping C-SALT has superficial appeal in perceived parity with personal limits, it rests on flawed assumptions about the nature of individual and corporate income taxes.

7 min read

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

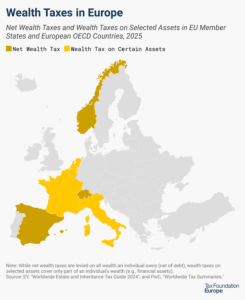

Wealth taxes not only collect little revenue and create legal uncertainty, but an OECD report argues that they can also disincentivize entrepreneurship, harming innovation and long-term growth.

5 min read