All Related Articles

Georgia Income Tax Reform Would Improve Standing Among Neighbors, Country

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

10 Tax Reforms for Growth and Opportunity

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

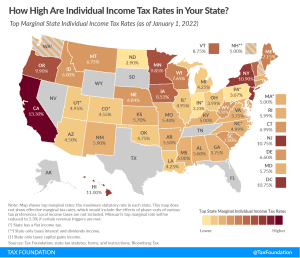

State Individual Income Tax Rates and Brackets, 2022

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

Sources of U.S. Tax Revenue by Tax Type, 2022

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min readSources of Government Revenue in the OECD, 2022

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Rate Reductions Would Put Michigan in Top 10

Amid record surpluses, Michigan lawmakers are looking to give relief to taxpayers and enhance the state’s competitive standing.

3 min read

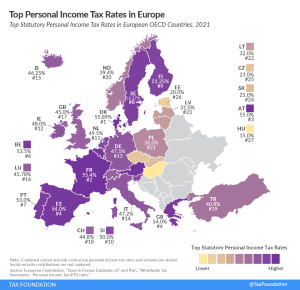

Top Personal Income Tax Rates in Europe, 2022

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

States on the Move: Cutting Across Party Lines

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done. We discuss why states are looking to make so many tax changes now and how these proposals might play out in statehouses.

Mississippi Nears Income Tax Repeal but Additional Work Is Necessary

Before declaring victory, it is imperative to get the details right. The latest proposal is a drastic improvement over the last one, but there is still more work to be done if the Magnolia State is to sustain the intended transformation.

7 min read

Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Summary of the Latest Federal Income Tax Data, 2022 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

41 min read

What the U.S. Can Learn from the Adoption (and Repeal) of Wealth Taxes in the OECD

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read

State Tax Changes Effective January 1, 2022

Twenty-one states and D.C. had significant tax changes take effect on January 1, including five states that cut individual income taxes and four states that saw corporate income tax rates decrease.

17 min read

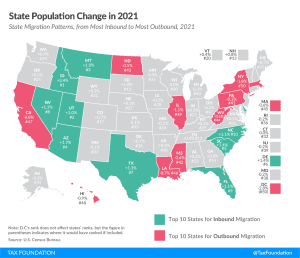

California Considers Doubling its Taxes

Practically doubling state taxes—even if the burden is partially offset through state-provided health coverage—could send taxpayers racing for the exits.

6 min read

Americans Moved to Low-Tax States in 2021

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read

2022 State Business Tax Climate Index

While there are many ways to show how much is collected in taxes by state governments, our State Business Tax Climate Index is designed to show how well states structure their tax systems and provides a road map for improvement.

169 min read

Permanent Build Back Better Act Would Likely Require Large Tax Increases on the Middle Class

Policymakers and taxpayers should understand the scope of tax changes necessary to fully pay for the large-scale social spending programs that would be initiated under the Build Back Better Act.

6 min read

Arkansas’s Sustainable Tax Reform: A Gift That Will Keep On Giving

Faced not only with immediate surpluses but with the expectation of sustained revenue growth in coming years, Arkansas policymakers have chosen to return some of the additional revenue to taxpayers in the form of individual and corporate income tax rate reductions, with additional rate cuts if future revenues permit.

6 min read