All Related Articles

Top State Tax Ballot Initiatives to Watch in 2018

Explore our list of the top state tax ballot measures to watch for throughout the country.

11 min read

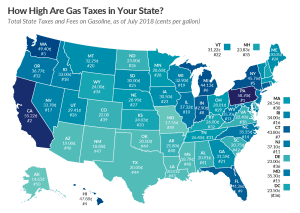

Gas Tax Rates by State, 2018

2 min read

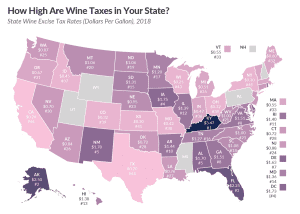

How High Are Wine Taxes in Your State?

1 min read

Sales Taxes on Soda, Candy, and Other Groceries, 2018

When policymakers get in the habit of handpicking goods for which the sales tax does or does not apply, the tax base simultaneously erodes and becomes more complex.

25 min read

Taxation, Representation, and the American Revolution

James Otis’s rallying cry of “taxation without representation is tyranny!” became the watchwords of the American Revolution and remain familiar to our ears. American independence, which we celebrate each year, was born of a tax revolt.

6 min read