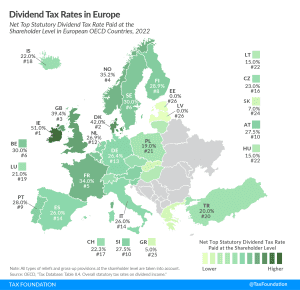

Dividend Tax Rates in Europe, 2023

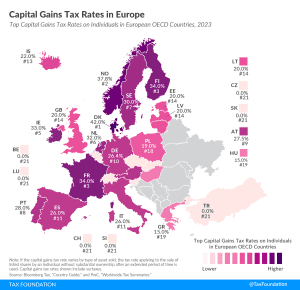

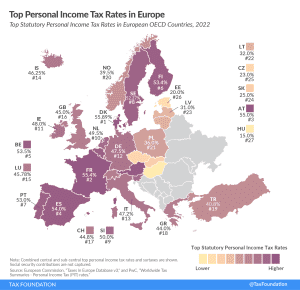

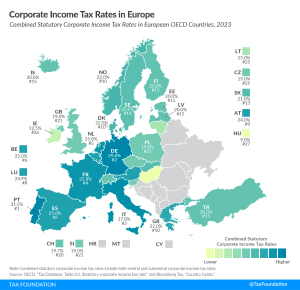

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

3 min read