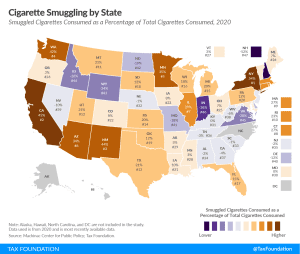

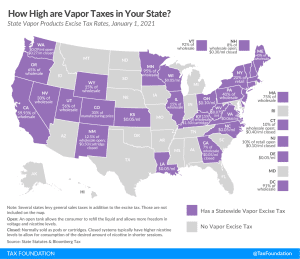

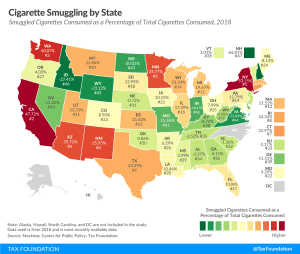

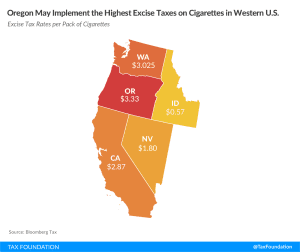

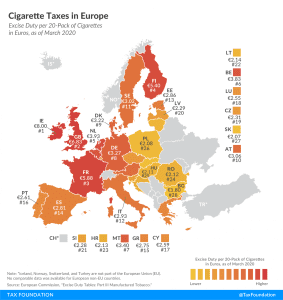

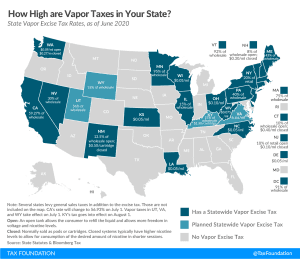

Compare Tobacco Tax Data in Your State

Tobacco is the most highly taxed consumer product in the United States. The tools on this page allow you to explore state tax rates and the effects tax policy and tobacco regulations can have on state revenues, smuggling, and effective tax rates for different income groups.

2 min read