All Related Articles

Iowa Enacts Sweeping Tax Reform

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

2022 Tax Brackets

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

Don’t Add More Temporary Tax Policies in Budget Reconciliation

Temporary policy creates uncertainty for taxpayers and scheduling more expirations will add to the already-expiring provisions under the Tax Cuts and Jobs Act (TCJA) of 2017.

3 min read

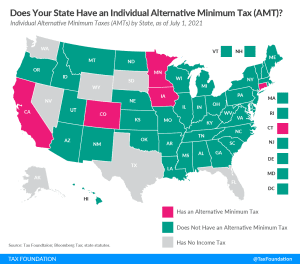

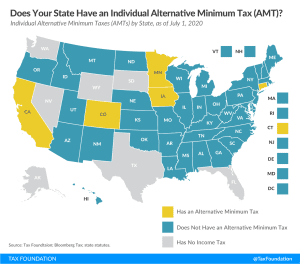

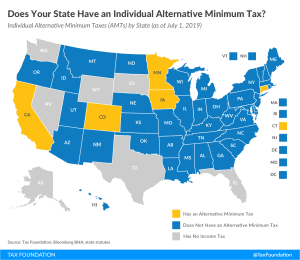

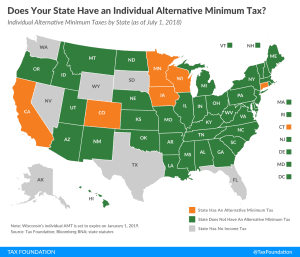

Does Your State Have an Individual Alternative Minimum Tax (AMT)?

The original goal of AMTs—to prevent deductions from eliminating income tax liability altogether—can be accomplished best by simplifying the existing tax structure, not by creating an alternative tax which adds complexity and lacks transparency and neutrality.

2 min read

A Closer Look at Eliminating the AMT

In our new Options for Reforming America’s Tax Code 2.0, there are several options that would simplify the tax code, including eliminating the alternative minimum tax (AMT). While this move would remove a source of complexity, policymakers should also consider reforming the deductions that created a justification for the AMT in the first place.

3 min read

Evaluating Proposals to Increase the Corporate Tax Rate and Levy a Minimum Tax on Corporate Book Income

President Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations, to raise revenue for new spending programs. Our new modeling analyzes the economic, revenue, and distributional impact of these proposals.

46 min read

Changes to the Tax Base Matter When Evaluating the Impact of Tax Reforms

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

What Federal Policymakers Can Learn from Business Tax Refunds in 2020

Policymakers should consider finding ways to simplify the administration of relief during future crises. This will help ensure the relief is timely and targeted, key components of any successful relief package for this crisis or crises in the future.

3 min read

2021 Tax Brackets

The IRS recently released the new 2021 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

6 min read

A Carbon Tax to Make the TCJA’s Individual Provisions Permanent

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

Does Your State Have an Individual Alternative Minimum Tax (AMT)?

Under an individual AMT, many taxpayers are required to calculate their income tax liability under two different systems and pay the higher amount.

2 min read

2020 Tax Brackets

The IRS recently released the new 2020 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

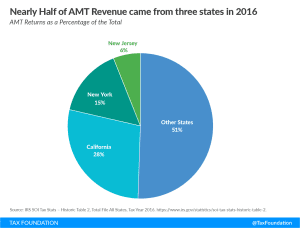

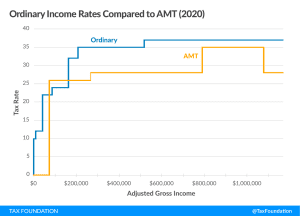

The Alternative Minimum Tax Still Burdens Taxpayers with Compliance Costs

Although Congress intended the AMT to be a tax on wealthy taxpayers, for much of its history it has subjected middle-income taxpayers in high-tax states to heavy compliance burdens. TCJA reforms that have increased the AMT’s exemption and exemption phaseout threshold will shield some taxpayers from the AMT through 2025, but the number of taxpayers impacted will increase in 2026 when the TCJA’s individual income tax reforms expire.

14 min read

2019 Tax Brackets

The IRS recently released its 2019 individual income tax brackets and rates. Check out the new standard deduction, child tax credit, earned income tax credit, rates and brackets, and more.

5 min read

The Tax Cuts and Jobs Act Simplified the Tax Filing Process for Millions of Households

The newly expanded standard deduction will reduce the time taxpayers spend working on Form 1040 by 4 to 7 percent, translating into $3.1 to $5.4 billion saved annually.

15 min read