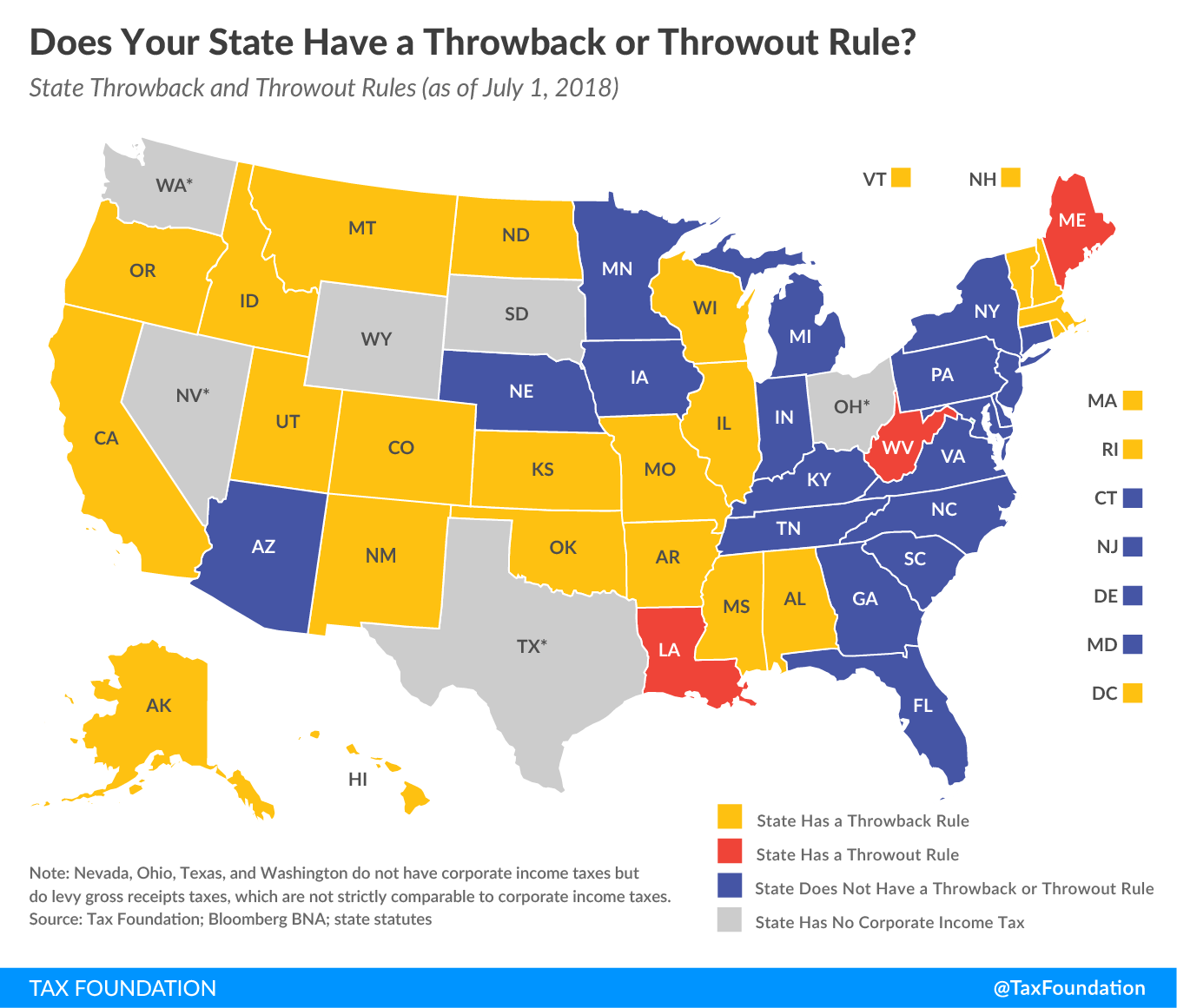

This week’s state tax map examines states that have a throwback or throwout rule in their corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code. Throwback and throwout rules are not widely understood, but they have a notable impact on business location and investment decisions.

For purposes of corporate taxation, multistate businesses are required to apportion their income among the states in which they operate. Most apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. formulas assign weighting among three factors–property, payroll, and sales–to determine the amount of income taxed by each state in which the business operates. The goal of apportionment is to prevent double taxation of corporate income, but there is wide variation among states in how apportionment formulas are designed. For example, some states weight the three factors equally, while others weight the sales factor more heavily or use it as the only factor.

When companies sell into states in which they do not have legal nexus for corporate income tax purposes, this can result in what is known as “nowhere income,” or income that is not taxed by any state. States with throwback or throwout rules seek to counter this phenomenon. As such, businesses with nowhere income from sales into states where they are not taxable are required to “throw” that income “back” into the state where the sale originated, even though the income was not earned in that state.

Although throwback rules are more common, three states adopt what are known as throwout rules. The difference is in how the “nowhere income” is treated. In both cases, the state is looking at a fraction: the amount of sales associated with the state over total sales. With a throwback rule, “nowhere income” is placed in the numerator (the amount apportioned to the state). With a throwout rule, it is removed from the denominator (the amount of total sales). Both increase in-state tax liability, though throwback rules are more aggressive than throwout rules.

Throwback and throwout rules discourage investment and are inconsistent with the purpose of apportionment, which is to tax the share of a company’s income reasonably associated with that state—not to tax revenue clearly associated with other states just because those states are unable to tax that income.

States with corporate income taxes are nearly evenly divided between those that have a throwback or throwout rule and those that do not. The map below shows throwback rules in 22 states and the District of Columbia, as well as throwout rules in three states.

Errata: An earlier version of this blog post misstated how nowhere income arises. This post has been revised to reflect that nowhere income is generated when companies sell into a state in which they do not have nexus for corporate tax purposes. The post has also been expanded to include throwout in addition to throwback rules.

Share this article