Exploring the Impact of the 2024 Tax Relief Act

We’re exploring the intricacies of the latest congressional act stirring up Washington—The Tax Relief for American Families and Workers Act of 2024.

We’re exploring the intricacies of the latest congressional act stirring up Washington—The Tax Relief for American Families and Workers Act of 2024.

Financial literacy is a problem that educators around the country are trying to tackle. Today, we’re speaking with Jed Collins, a former NFL player, who is leading the charge in the financial education arena by guiding high school and college students, as well as professional athletes, through the world of finance.

Taxes have played a major role throughout history, and even date back to around 5,000 years ago. Taxes will continue to affect our lives and shape our societies just like they have for thousands of years.

Americans are saving less. While the U.S. saving rate has regularly lagged behind its peers, it has yet to return to pre-pandemic levels. Increasingly, people are turning to credit cards to fill the gaps in their budgets.

Every policy has trade-offs, but a well-designed carbon tax has the potential to protect the environment without harming consumers, jobs, or businesses.

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

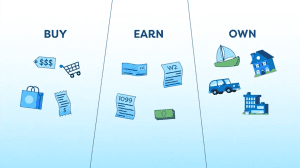

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.

On this “not-so-heavy-on-the-policy” episode, our much-beloved host, Jesse Solis, is joined by the Deduction’s Senior Producer, Dan Carvajal, and Marketing Associate, Kyle Hulehan, to share some bittersweet news.

The FairTax, on paper, sounds simple. But when you pull back the curtains, this proposal leads to more questions than answers.

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.