Key Takeaways

- Taxes have impacted many things across history, from the rise and fall of entire nations, to the food you eat and the car you drive. Taxes have sparked revolutionary wars and even revolutions in products and business.

- Many of our most basic tax types like income taxes, property taxes, sales taxes, and tariffs have been around since early civilization, around 5,000 years ago.

- In ancient Egypt, before they were even using coined currency, the Pharaoh collected a 20 percent tax on all grain harvests.

- Julius Caesar implemented the first sales tax.

- Caesar Augustus instituted a direct income tax.

- The Magna Carta introduced the revolutionary concept that the king couldn’t levy new taxes without the consent of the governed in 1215 A.D.

- Even the American Revolution in the 18th century was spawned by outrage over taxes. The colonists believed deeply that taxation without representation was tyranny, and they were unwilling to stand for taxes imposed without their consent.

- Taxes also affect our economies and fund government priorities, influence who we elect into office, and even where we live. Their impact is all around us.

- The design of tax policy is just as important as the execution. Sound tax policy is:

- Simple

- Neutral

- Transparent

- Stable

- Taxes likely aren’t going anywhere any time soon, and better tax policy can truly change the course of history.

Transcript

There’s one word that has impacted virtually every era of recorded history.

From the rise and fall of entire nations, to the food you eat and the car you drive. From revolutionary wars, to revolutions in fashion. That word is…taxes.

Yep, taxes. It turns out that many of our most basic tax types have been around since early civilization, and they’ve been shaping history and society ever since.

Our first record of taxation dates back 5,000 years to ancient Egypt. Before they were even using coined currency, the Pharaoh collected a 20 percent tax on all grain harvests. Julius Caesar implemented the first sales tax, and his great nephew slash adopted son, Caesar Augustus, instituted a direct income tax.

Not only have taxes been around basically forever, they’ve also played a huge role in all sorts of major historical events.

The Magna Carta is rightly remembered for establishing the rule of law and, of course, banning fishing traps. The Great Charter also introduced the revolutionary concept that the king couldn’t levy new taxes without the consent of the governed.

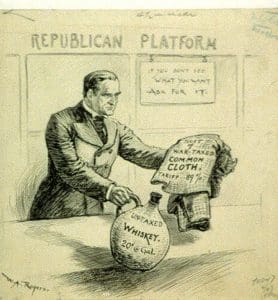

Speaking of revolutions and consent, let’s talk about the American Revolution. It’s well-known that taxes lit the fuse for the Revolution. But the colonial outrage wasn’t about the tax burden itself, which is often the problem. Rather, the outrage was over design and execution.

The colonists believed deeply that taxation without representation was tyranny, and they were unwilling to stand for taxes imposed without their consent.

Even if they’re not sparking rebellions, taxes affect our economies and fund government priorities. They influence who we elect into office and where we live, and they impact countless other aspects of our lives.

And whether the outcomes of taxation are positive, negative, or revolution-worthy depends on how well-crafted the policies behind them are. As a baseline, tax policies that are simple, neutral, transparent, and stable are the most effective. And the ones that aren’t cause the most problems.

Either way, taxes will continue to affect our lives and shape our societies just like they have for thousands of years.