A new tax expenditures report by the Joint Committee on Taxation (JCT) reveals two problematic developments: 1) policymakers have increasingly relied on the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code to deliver benefits to individuals, and 2) the broad, neutral tax treatment of investment has shifted to targeted subsidies for businesses.

Tax expenditureTax expenditures are a departure from the “normal” tax code that lower the tax burden of individuals or businesses, through an exemption, deduction, credit, or preferential rate. Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit (EITC), child tax credit (CTC), deduction for employer health-care contributions, and tax-advantaged savings plans. s are often akin to “spending through the tax code,” or policies aimed at goals beyond simple revenue generation, like special treatment for a certain activity. The more technical definition given by the JCT is a tax provision that deviates from how an activity would be taxed under a “normal tax system.”

We have written previously about our disagreement over what constitutes a “normal tax system,” as the JCT’s definition categorizes important structural elements of the tax system as expenditures, overestimating truly targeted spending through the tax code by including broad provisions that treat savings and investment evenly as tax breaks. Nonetheless, the tax expenditures reports illustrate how spending through the tax code has changed over time.

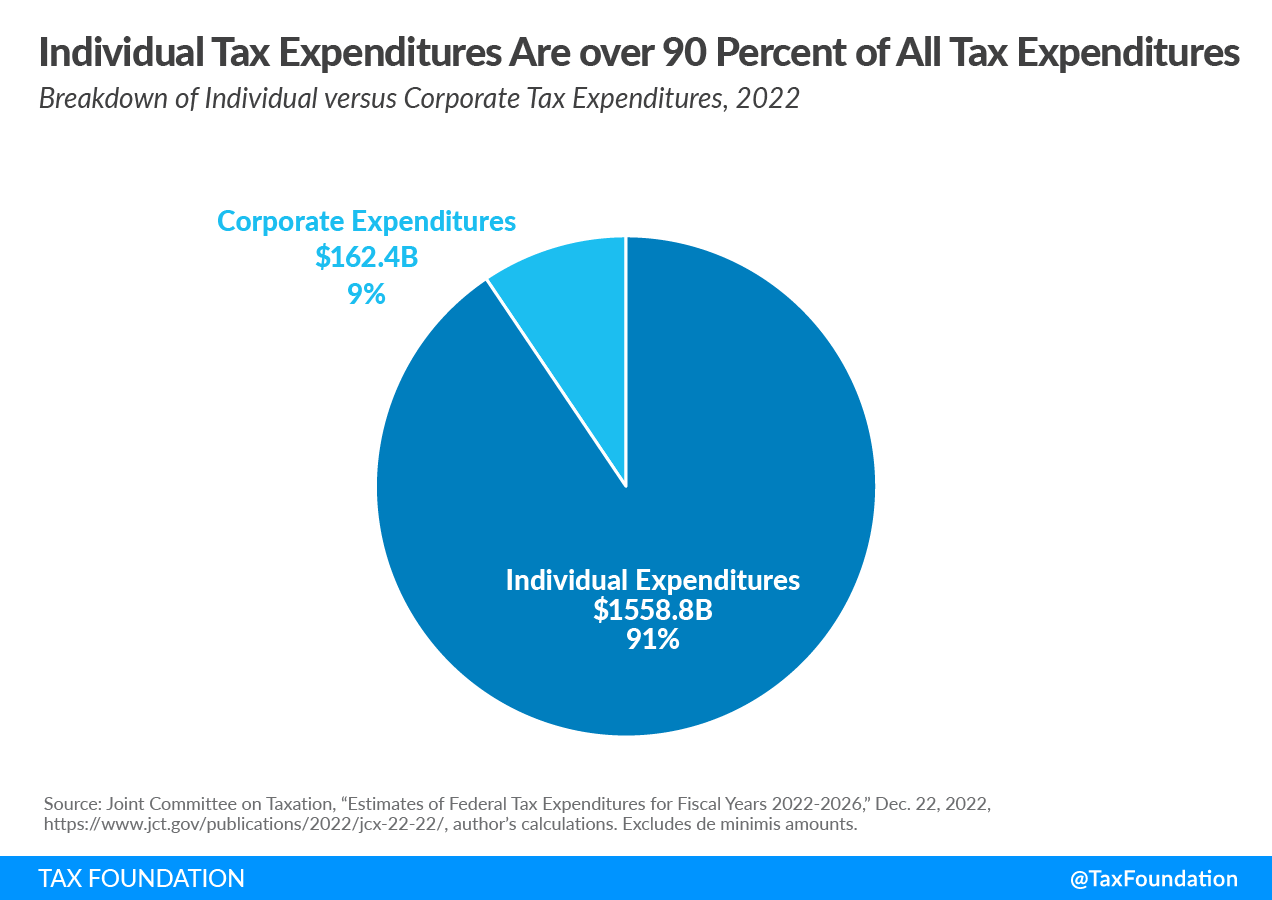

In 2022, tax expenditures totaled over $1.72 trillion, compared to an estimated $3 trillion in individual and corporate tax revenue. Just over $160 billion of expenditures were on the corporate tax side, while the other $1.56 trillion were on the individual tax side.

Over the past several years, the individual share of expenditures has significantly grown, rising from 82 percent of expenditures in 2018 to 91 percent in 2022, largely driven by pandemic-era relief administered through the tax code as well as corporate tax changes.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2022 | |

|---|---|---|---|---|---|---|

| Total Expenditures (Billions) | $1,487 | $1,498 | $1,467 | $1,455 | $1,762 | $1,721 |

| Corporate Expenditures (Billions) | $267 | $259 | $202 | $199 | $170 | $166 |

| Individual Expenditures (Billions) | $1,220 | $1,239 | $1,266 | $1,256 | $1,592 | $1,559 |

| Corporate Expenditures Share | 18% | 17% | 14% | 14% | 10% | 9% |

| Individual Expenditures Share | 82% | 83% | 86% | 86% | 90% | 91% |

|

Note: Excludes de minimis amounts. The JCT did not release an expenditures report in 2021. Source: Joint Committee on Taxation, author’s calculations. |

||||||

In 2019, the JCT forecast a total of $1.5 trillion in expenditures for 2020, and in 2020, they forecast $1.6 trillion for 2022. (They did not publish a 2021 tax expenditures report in the midst of the pandemic.) In both years, the forecasts undershot the actual amount of expenditures, and pandemic relief explains nearly all the difference.

In 2020, actual expenditures totaled nearly $1.8 trillion, $233 billion above the forecast. The Recovery Rebates enacted in the CARES Act in March 2020 were the largest tax expenditure in 2020, costing $269 billion in lost tax revenue according to the 2020 JCT report. While the stimulus checks were not the only policy change to tax expenditures during the pandemic, they explain most of that gap.

Similarly, expenditures in 2022 were $135 billion above the forecast, at a total of $1.7 trillion. The main driver of the gap? The Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. (CTC) expansion passed in the American Rescue Plan in March 2021. While the CTC expansion was only in effect for one year, it left a large mark on the budget: it cost $184.7 billion in 2022, compared to the 2020 report’s projection of $115.6 billion. That $69.1 billion gap is more than half the difference between projected and actual expenditures for 2022.

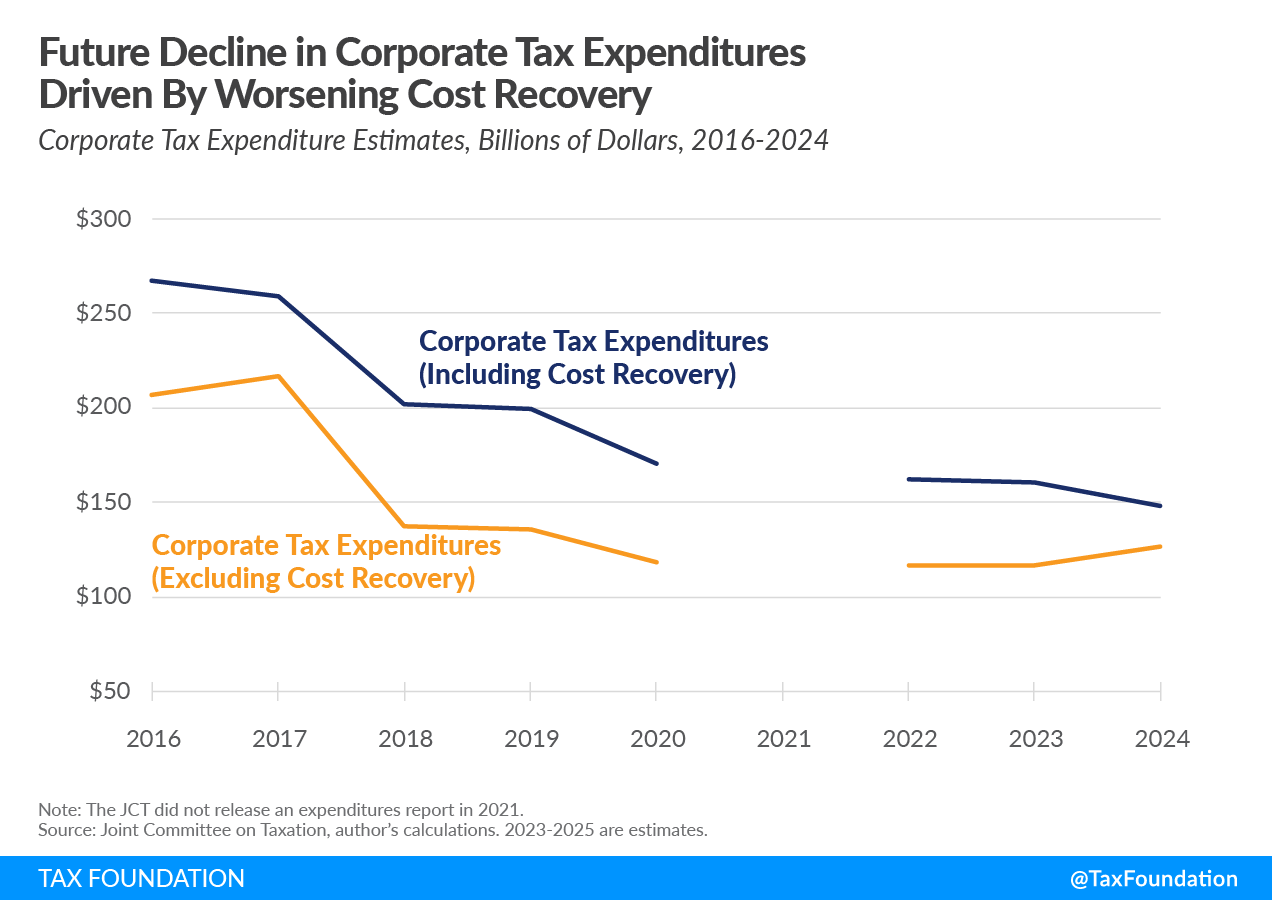

While individual expenditures have grown, corporate expenditures have declined.

The most important driver of the decline is technical. In late 2017, the Tax Cuts and Jobs Act (TCJA) lowered the corporate tax rate from 35 percent to 21 percent. The lower rate mechanically reduced the value of provisions corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). s use to lower their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , thus reducing the revenue cost.

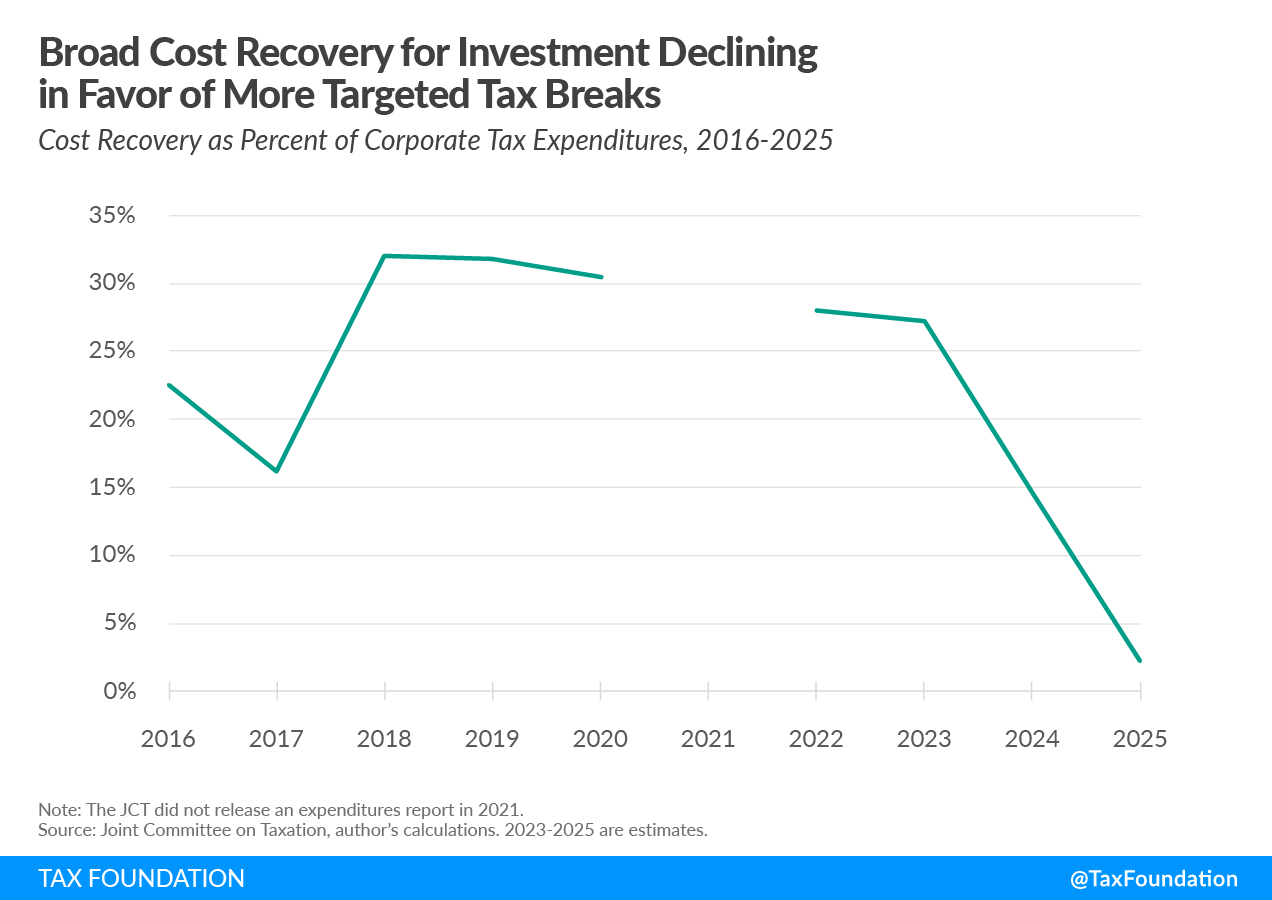

Under the JCT’s methodology, accelerated deductions for capital investments count as tax expenditures, even though they would be a normal structural part of a cash flow tax. In 2017, the TCJA increased such deductions by introducing 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. for equipment, available on a temporary basis until a four-year phaseout that began at the start of 2022.

While the rate reduction in the TCJA reduced the value of corporate expenditures overall, bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. caused the cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. share of total corporate tax expenditures to rise significantly—from just 16 percent in 2017 to 32 percent in 2018. Going forward, as bonus depreciation begins phasing out, the JCT forecasts cost recovery deductions will decline in value and as a share of corporate tax expenditures.

As 100 percent bonus depreciation phases out, aggregate corporate expenditures will fall. But, when excluding cost recovery deductions, corporate tax expenditures are expected to increase in future years, partly due to an increase in targeted corporate subsidies enacted in the InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act.

The increasing reliance on the tax code as a tool for delivering social benefits was a major cause of recent troubles at the IRS; in the midst and aftermath of the pandemic, the IRS had to scramble to handle a substantial increase in responsibilities. Going forward, it would be prudent to use non-tax agencies to administer social benefits—and even consider moving existing tax-based social policy into a more proper government agency’s purview. Meanwhile, on the corporate side, the decline in investment deductions and expansion of more targeted subsidies underscores the need for broad corporate tax reform: making expiring TCJA investment provisions permanent while repealing specific corporate tax breaks.

Share