A tax reciprocity agreement is a pact between two or more states not to tax the income of workers who commute into the state from another state covered by the agreement. Reciprocity agreements reduce compliance burdens for commuters by requiring them to file taxes only in their state of residence, not in the state into which they commute.

Why Have Tax Reciprocity?

When a person lives in one state but works in another, they may have tax liability in both states. To eliminate double taxation of that income, they typically receive a tax credit from their home state.

Tax reciprocity further simplifies the income tax filing requirements for the taxpayer, who then has to comply with the income tax code of their home state. Take this example from our research on telework taxation:

Consider, for instance, a resident of Virginia, which participates in a reciprocity agreement with the District of Columbia, where the taxpayer’s office is located. Under the agreement, the taxpayer only incurs tax liability where she is domiciled (Virginia) and can disregard the District’s income tax code entirely.

On the other end of the spectrum, five states tax people where their office is, even if they do not actually work in the state. These individuals may be denied their home state’s credit for taxes paid to another state (since the work was performed in their home state), subjecting them to double taxation. This is referred to as the convenience of the employer rule, or just the “convenience rule” for short.

Six states had a convenience rule in place pre-pandemic, with Massachusetts adopting a similar rule during the pandemic to continue taxing nonresidents who formerly commuted into the state. Massachusetts’ rule has since been allowed to expire, and Arkansas lawmakers repealed their rule, leaving five remaining—most notably in New York, which is the most aggressive in its taxation of nonresident income, but also in Connecticut, Delaware, Nebraska, and Pennsylvania.

Absent a convenience rule, living in one state and working in another typically does not entail double taxation, but it does require filing and paying taxes to multiple states, with one’s tax burden equaling whichever is the higher of the two burdens.

When double taxation results (mainly from convenience rules) this violates two of the four principles of sound tax policy: simplicity and neutrality. Even when filing requirements in multiple states do not result in double taxation, they still dramatically increase compliance costs and lead to most of the taxpayer’s liability going to the state in which they work, even though they are likely to receive a return on investment in the state in which they reside.

The rise of hybrid work arrangements, where employees may work in the office some days while telecommuting on others, makes tax filing even more complex for filers who commute to work across state lines. Reciprocity agreements make life easier for taxpayers by allowing far more of them to file income taxes with only one state.

What States Have Tax Reciprocity?

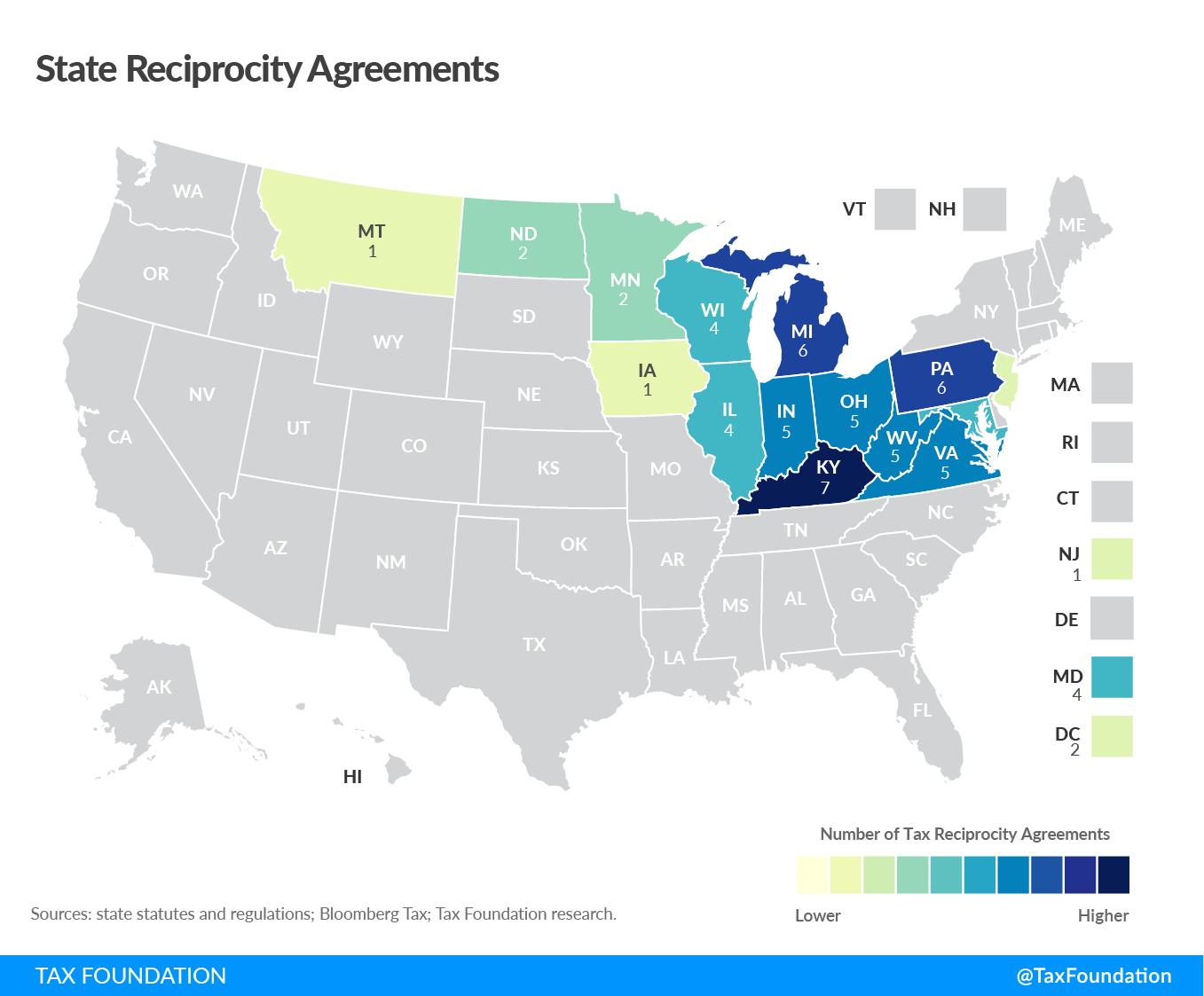

| IL | IN | IA | KY | MD | MI | MN | MT | NJ | ND | OH | PA | VA | WV | WI | DC | Count | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IL | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||

| IN | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| IA | ✓ | 1 | |||||||||||||||

| KY | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7 | |||||||||

| MD | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||

| MI | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 | ||||||||||

| MN | ✓ | ✓ | 2 | ||||||||||||||

| MT | ✓ | 1 | |||||||||||||||

| NJ | ✓ | 1 | |||||||||||||||

| ND | ✓ | ✓ | 2 | ||||||||||||||

| OH | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| PA | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 | ||||||||||

| VA | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| WV | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | |||||||||||

| WI | ✓ | ✓ | ✓ | ✓ | 4 | ||||||||||||

| DC | ✓ | ✓ | 2 | ||||||||||||||

| Sources: State statutes and regulations; Bloomberg Tax; Tax Foundation research. | |||||||||||||||||

Related Webinar

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe