A property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

In the United States

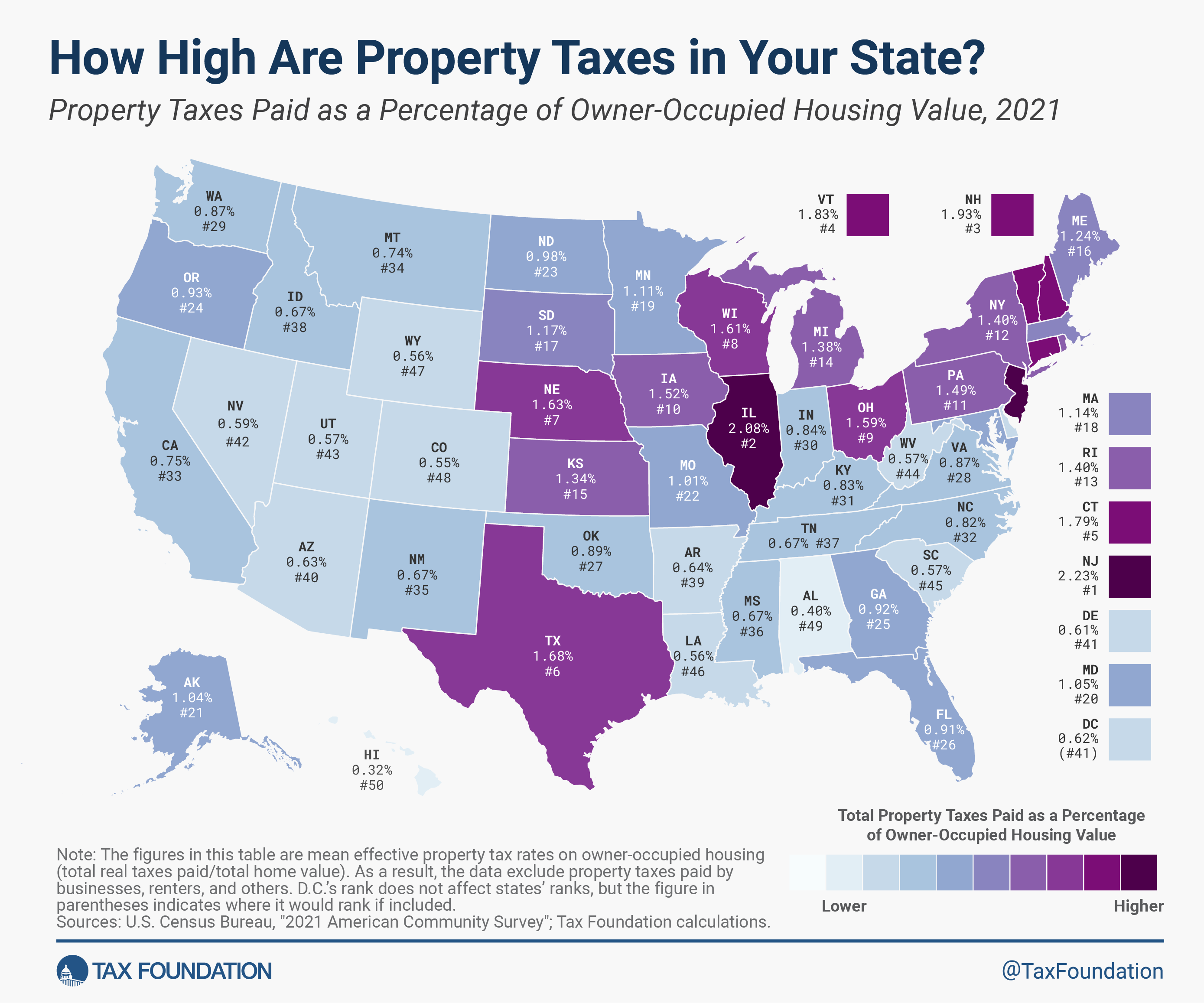

Property taxes are an essential source of revenue for state and local governments in the United States, accounting for over 30 percent of total state and local tax collections and over 70 percent of total local tax collections.

Local governments rely on property tax revenue to fund important public services like schools, roads, police departments, fire and emergency medical services, and other services associated with residency or property ownership.

Taxes on real property conform to the “benefit principle,” or the idea that the taxes a person pays should relate to the benefits received. In general, residents benefit from the state and local services that their property tax dollars fund.

Property tax rates vary greatly among states and localities and tend to be what taxpayers focus most on, but the property tax base—what is and isn’t taxable—can also have a significant impact on business investment and location decisions.

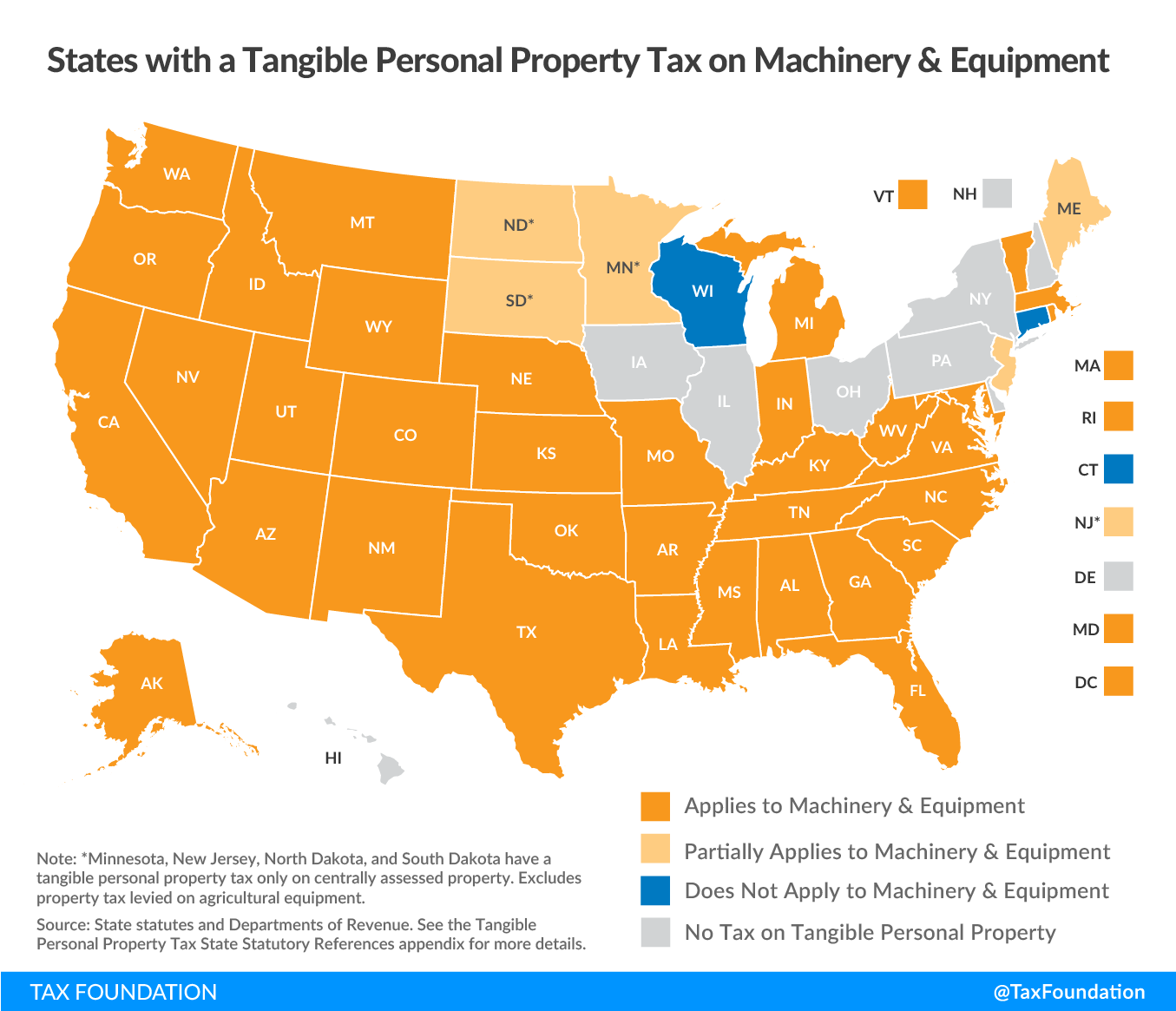

While most people are familiar with residential property taxes on immovable property like land and structures, known as “real” property taxes, many states also tax tangible personal property (TPP) owned by individuals and businesses.

Overall, taxes on real property are relatively stable, neutral, and transparent, whereas taxes on tangible personal property like vehicles and equipment are more problematic.

Around the World

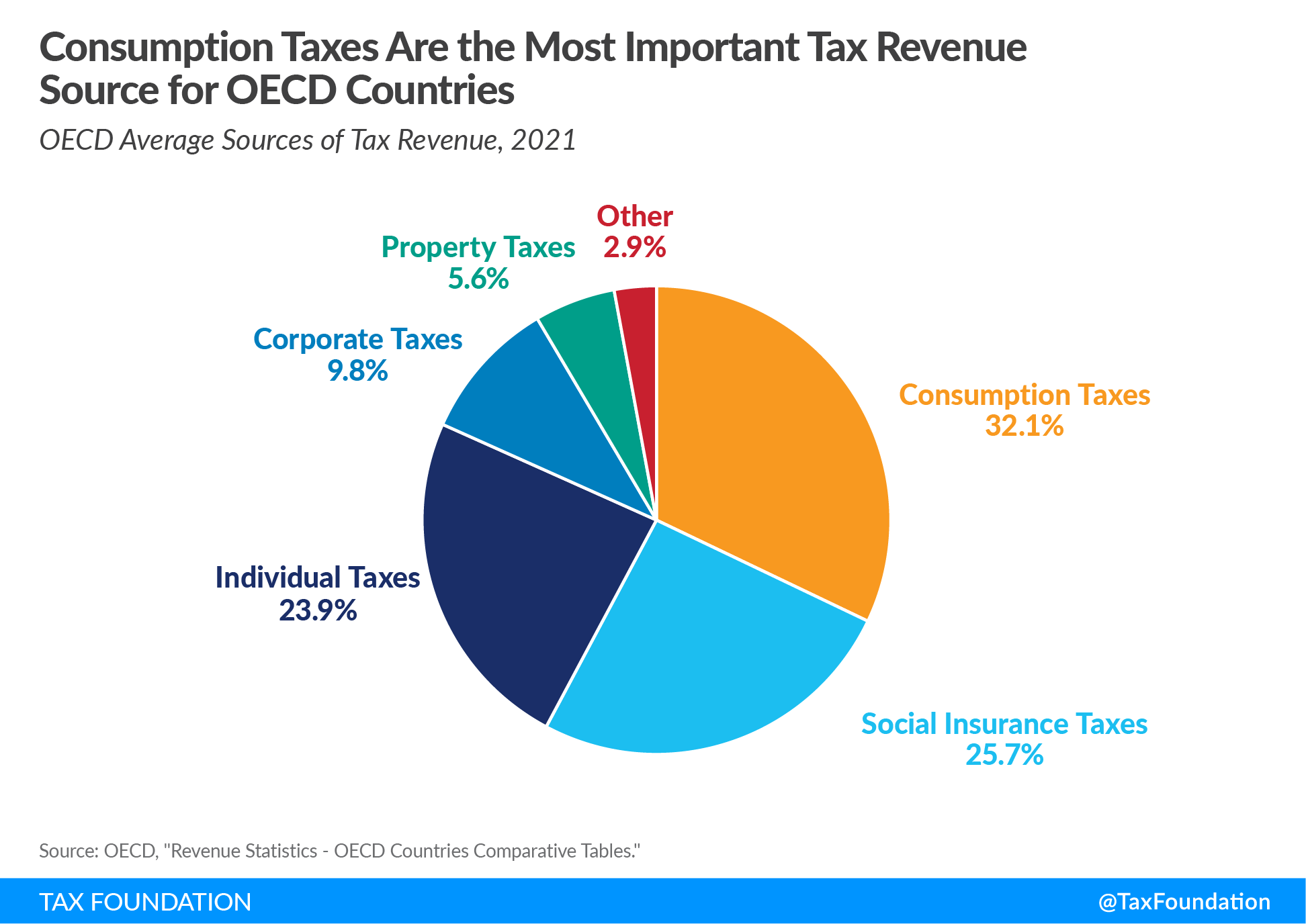

Despite their stability, transparency, and low propensity for economic harm, property taxes are a relatively minor source of revenue in most developed countries.

On average, countries in the Organisation for Economic Co-operation and Development (OECD) derive less than 6 percent of total revenues from property taxes.

Tangible Personal Property Taxes

Tangible personal property (TPP) is property that can be moved or touched, such as business equipment, machinery, inventory, furniture, and automobiles.

Taxes on TPP make up a small share of total state and local tax collections, but are complex, creating high compliance costs; are nonneutral, favoring some industries over others; and distort investment decisions.

TPP taxes place a burden on many of the assets businesses use to grow and become more productive, such as machinery and equipment. By making ownership of these assets more expensive, TPP taxes discourage new investment and have a negative impact on economic growth overall.

As of 2019, 43 states included TPP in their property tax base.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe