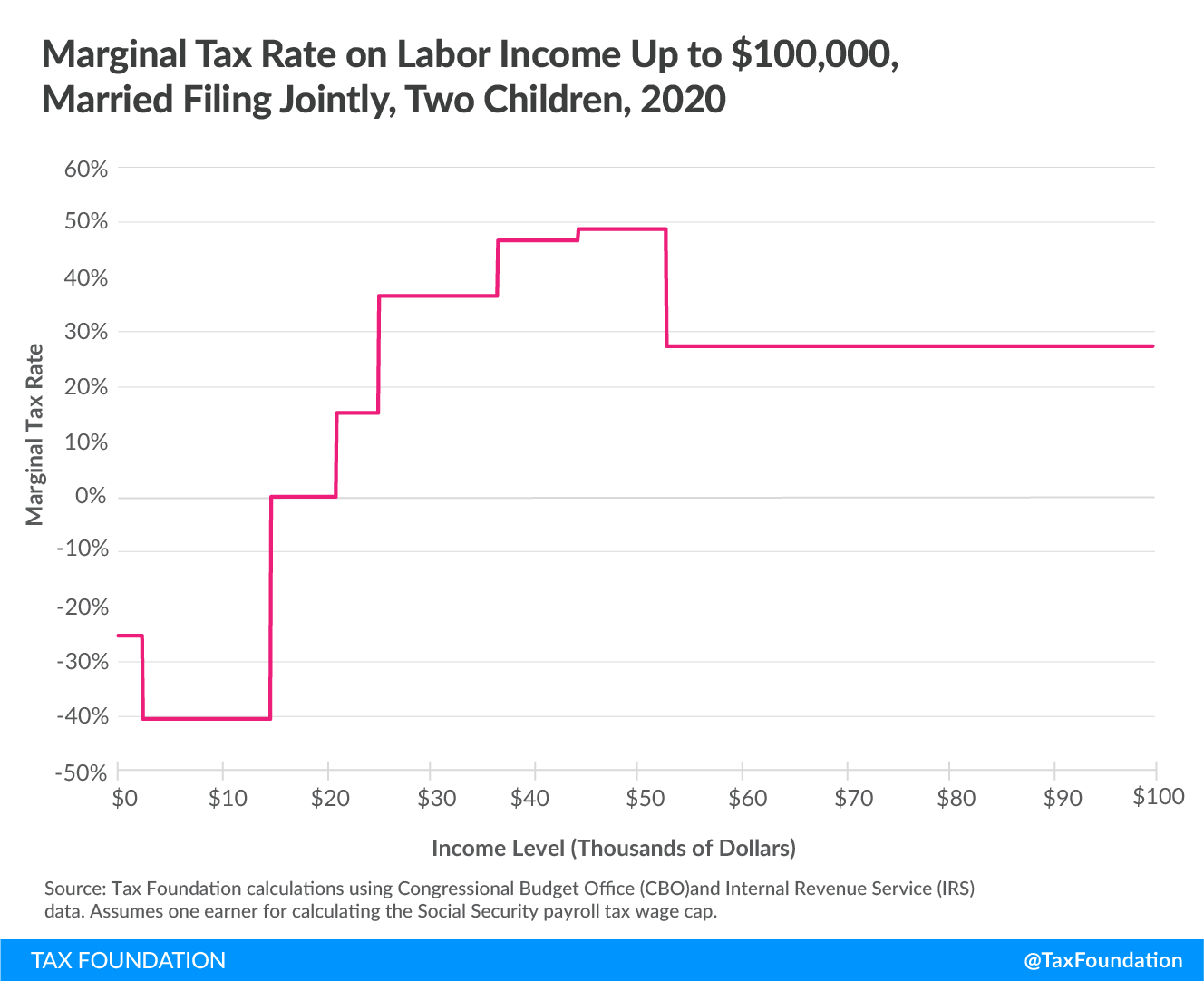

The marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax.

Statutory Marginal Tax Rates

In terms of the U.S. federal income tax system, your statutory marginal tax rate corresponds to the highest tax bracket you face (see below). This is considered “statutory” since it simply describes the top income tax bracket your income falls into as set by federal or state law.

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $243,700 to $609,350 |

| 37% | $609,350 or more | $731,200 or more | $609,350 or more |

| Source: Internal Revenue Service | |||

Marginal Effective Tax Rates

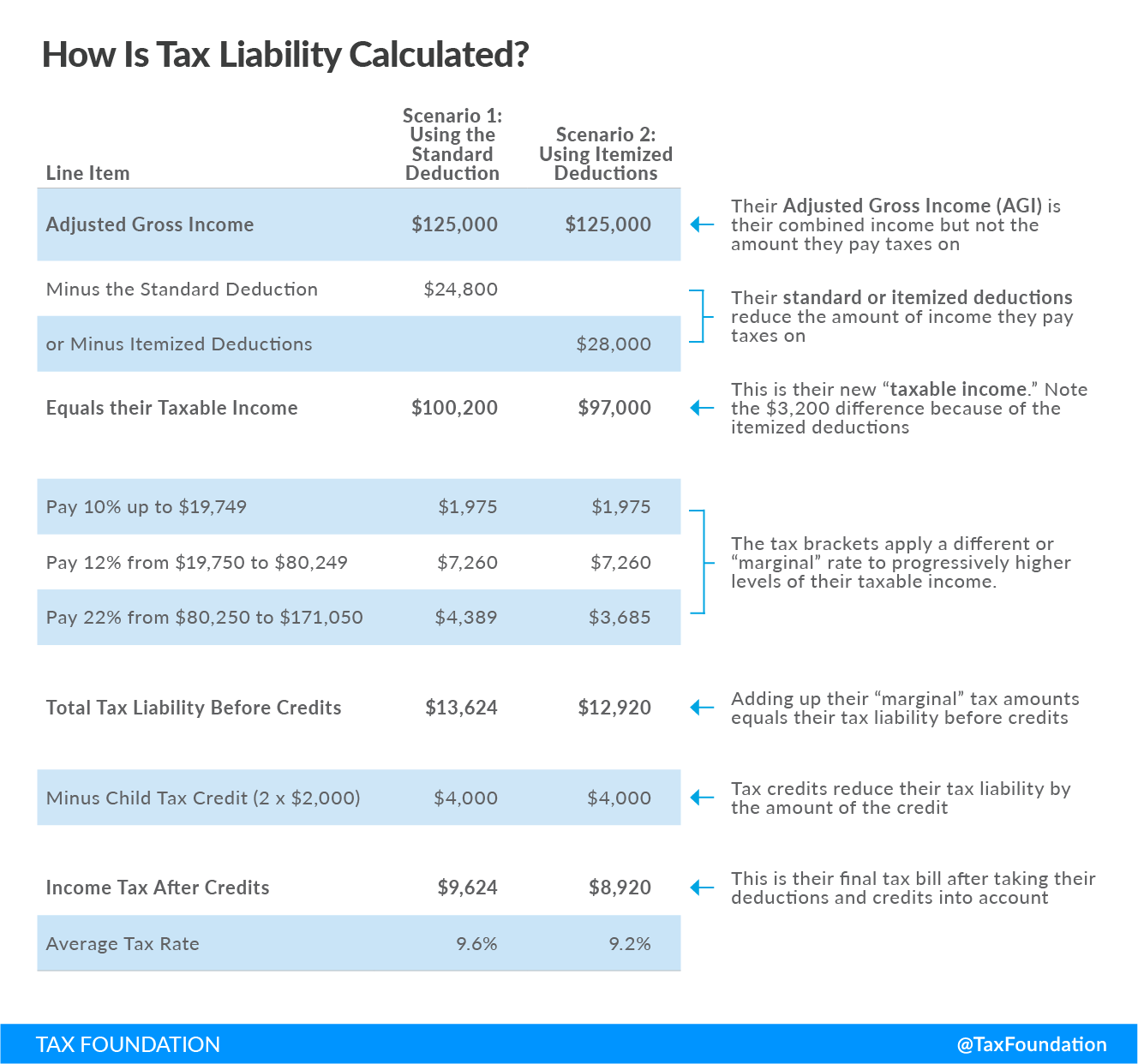

While useful in some contexts, statutory marginal tax rates do not paint a complete picture. “Effective” marginal tax rates are useful to calculate because they account for the multiple layers of taxes (such as the income tax and payroll tax) alongside relevant deductions and credits.

Take, for example, two taxpayers filing jointly with two children. At low levels of income, the taxpayers face negative marginal tax rates due to the fully refundable Earned Income Tax Credit (EITC) and partially refundable Child Tax Credit (CTC).

Both credits have separate phase-in and phaseout rates, thresholds, and refundability rules, which create changing effective marginal tax rates as taxpayer income rises. As the couple’s income rises above $15,000, the CTC and EITC phase-ins end, and the effective marginal tax rate rises above 0. Eventually, the taxpayers face a marginal tax rate of up to 46.36 percent when earning over $36,801 due to the phaseout of the EITC, the 15.3 percent payroll tax, and the 10 percent individual income tax.

Effective marginal tax rates are important to calculate because they show how workers may be discouraged to work additional hours and earn higher incomes. Higher effective marginal tax rates disincentivize additional work at the margin, which translates into lower productivity and economic growth overall.

On the business side, effective marginal tax rates account not only for statutory rates but also cost recovery and financing. Effective marginal tax rates for business income were significantly reduced by the 2017 Tax Cuts and Jobs Act (TCJA) but expiring provisions in that law will put upward pressure on marginal effective tax rates in the coming years.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe