Dynamic scoring estimates the effect of tax changes on key economic factors, such as jobs, wages, investment, federal revenue, and GDP. It is a tool policymakers can use to differentiate between tax changes that look similar using conventional scoring but have vastly different effects on economic growth.

What Is Included in Dynamic Scoring and How Is It Different from Static Scoring?

Dynamic scoring provides important context as to how taxes affect the economy by accounting for a policy’s macroeconomic and behavioral effects. By contrast, conventional (or static) scoring holds the size of the economy constant and doesn’t incorporate feedback. Two tax policies may have the same “conventional” score, but because one changes the incentive to work, save, and invest while the other does not, they can have different dynamic scores.

Accounting for these behavioral and macroeconomic changes under dynamic scoring shifts the tax debate past a simple argument over how much revenue we should raise to a more important debate over how we should raise revenue.

How Does Dynamic Scoring Work in Practice?

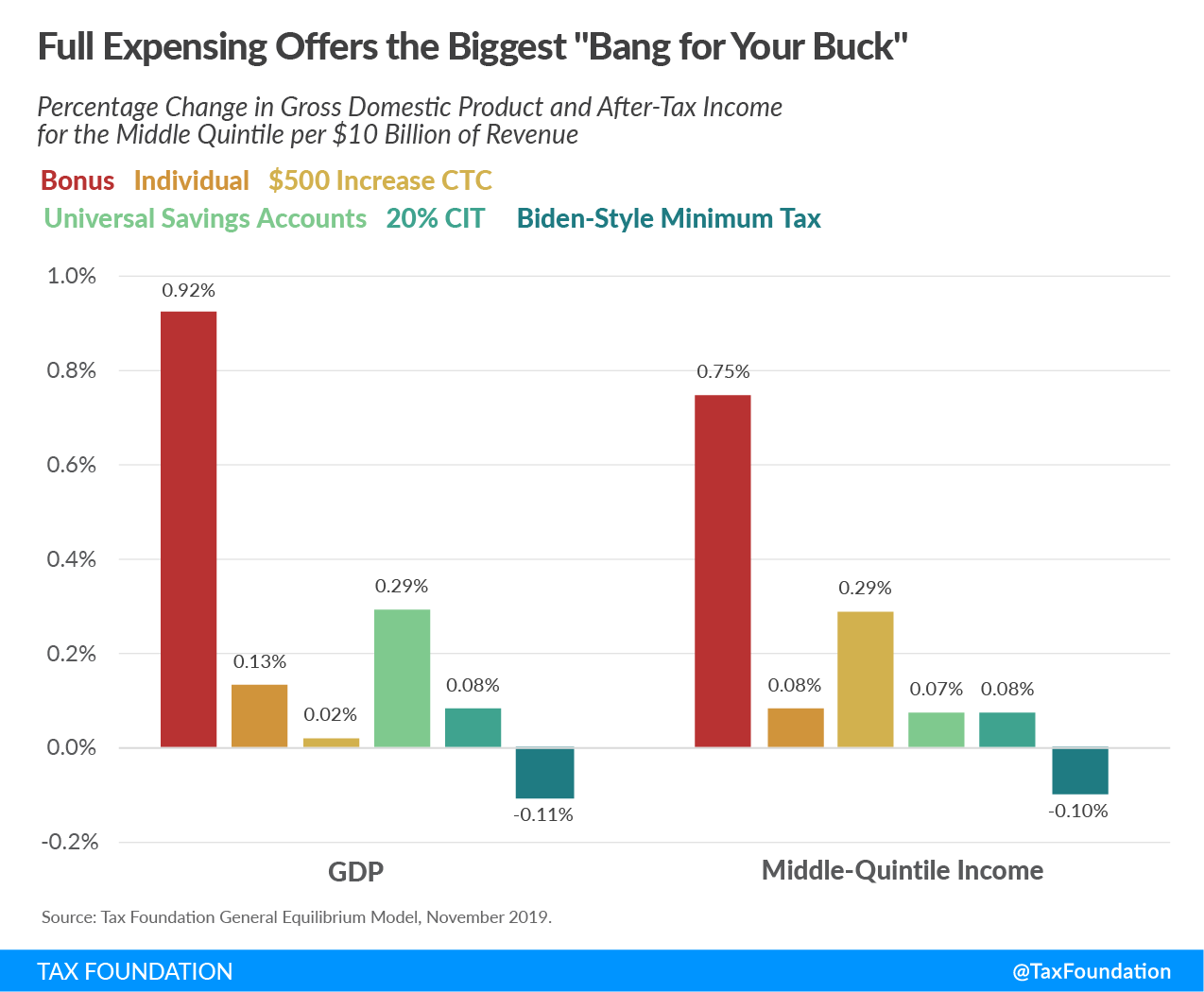

No two tax changes affect the economy the same way. Using dynamic scoring to measure the economic and revenue effects of different tax policies shows which changes offer the most “bang for your buck,” rather than looking only at the conventional score, which takes a static look at tax changes.

For example, we used the Tax Foundation General Equilibrium Model to compare four tax reductions and one tax increase:

- Making the Tax Cuts and Jobs Act (TCJA) 100 percent bonus depreciation permanent

- Making the TCJA individual provisions permanent

- Increasing the child tax credit (CTC) by $500

- Implementing $10,000 Roth-style universal savings accounts (USAs) for taxpayers making under $200,000

- Implementing a corporate minimum tax such as one implemented in 2023 by the Inflation Reduction Act (IRA).

Each of these policies has a different effect on individuals’ incentives to work and invest, thus eliciting a different effect on economic growth and incomes. Dynamic scoring helps illustrate the trade-offs among different tax proposals.

For example, we estimate that making the individual provisions permanent would increase long-run economic output by 2.2 percent, but this would reduce long-run federal revenue by $165 billion annually.

On the other hand, permanence for the TCJA 100 percent bonus depreciation would increase economic output by 0.9 percent at a long-run annual cost of $10 billion of revenue.

Proposals such as USAs, a larger child tax credit, or a 1 percentage-point corporate rate reduction are less efficient tax cuts in terms of economic output, while a corporate minimum tax is a less efficient revenue increase.

Dynamic scoring provides lawmakers with more information they can use to understand the effects of tax policies on a complex, multidimensional U.S. economy, whereas conventional scoring simply predicts the increase or decrease in revenue.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe