Spain’s Poorly Designed Tax Policy Hurts Its Competitiveness

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

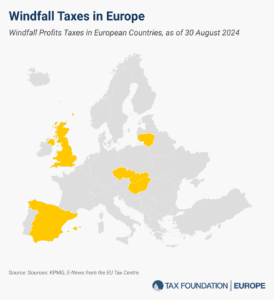

Even though energy prices have declined from their recent peak, the United Kingdom is one of the few countries in Europe continuing to rely on windfall profits taxes to support households with the rising cost of living.

4 min read

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

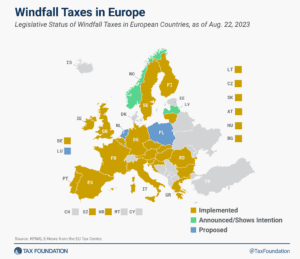

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

For many Italian banks, there hasn’t been a significant “windfall” to tax. The profit margins of Italian banks have been lower compared to other industries for the past two decades.

5 min read

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base.

13 min read

Spain should follow the examples of Italy and the UK and enact tax reforms that have the potential to stimulate economic activity by supporting private investment while increasing its international tax competitiveness.

7 min read

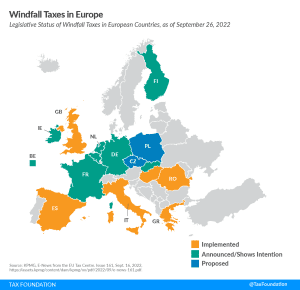

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

History is clear. Lowering budget deficits via spending restraint frees resources for additional private output and jobs. Lowering them by raising taxes on business investment and labor services makes it harder to dis-inflate without a recession.

7 min read

California is no stranger to high taxes, and the state has enough going for it that its economy can withstand higher tax burdens than would be viable in other parts of the country. But there’s always a tipping point.

6 min read

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

Oil prices have skyrocketed, posing a new risk to the post-pandemic recovery. Feeling the pressure to respond, policymakers have proposed everything from gas tax holidays, tapping into strategic reserves, and even rebate cards. One idea that has crawled back from the dead: “Windfall Profits Taxes.” This idea is seemingly simple: legislation targeted at the “excess” profits of oil companies. However, as with anything in tax policy, the reality is much more complicated.

As oil prices skyrocket, a windfall profits tax targeted at oil company profits could punish domestic production and increase reliance on imports.

3 min read