FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min readSocial Security is by far the largest federal government spending program, constituting 21 percent of the federal budget, or $1.3 trillion, in FY 2023—larger than the entire nondefense discretionary budget. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term. By 2035, the Old-Age, Survivors, and Disability Insurance (OASDI) Trust Fund will be depleted, and current payroll taxes will only be able to fund 83 percent of the scheduled Social Security benefits. Absent any reforms, Social Security recipients would immediately face a 17 percent cut in benefits.

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

When you hear about tax policy, you may think of the IRS, the agency responsible for collecting federal taxes. But who is responsible for drafting, reviewing, assessing, and passing tax legislation at the federal level?

4 min read

What happens when the country’s most important retirement program runs out of money? Social Security faces a funding crisis by 2035. We unpack how the system works, why it’s in trouble, and what fixes could keep it afloat.

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

If lawmakers are serious about pro-growth policies and fiscal responsibility, they will need to put policies forward that achieve those goals. Simply adjusting the baseline doesn’t reduce actual deficits in the coming years.

7 min read

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).

6 min read

The Social Security trust funds face looming insolvency if policymakers don’t reform the program. One issue that garners a lot of attention in the debate over solutions is the payroll tax cap.

3 min read

Fiscal pressures are likely to weigh heavily on lawmakers as they craft a tax reform package. That increased pressure could result in well-designed tax reform that prioritizes economic growth, simplicity, and stability, or it could encourage budget gimmicks and economically harmful offsets. Lawmakers should avoid the latter.

8 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

By 2035, Social Security as we know it will largely be insolvent. If we want to fix the issue, it’s time for our parties’ leaders to reform the program so it can be around for the long run for all Americans.

CBO data shows that the federal fiscal system—both taxes and direct federal benefits—is getting more progressive and redistributive in 2024.

7 min read

Social Security is by far the largest federal government spending program. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term.

33 min read

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

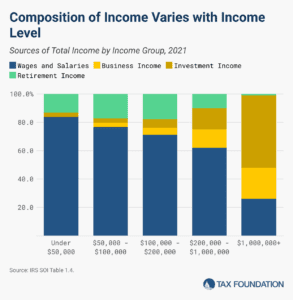

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

9 min read

Improving the country’s fiscal situation won’t be comfortable, but economic growth can help cushion the blow.

3 min read