Details and Analysis of President Biden’s American Jobs Plan

Details and analysis of the American Jobs Plan tax proposals. Learn more about the major tax changes in the proposed Biden infrastructure plan.

9 min read

Details and analysis of the American Jobs Plan tax proposals. Learn more about the major tax changes in the proposed Biden infrastructure plan.

9 min read

In a new report, the Congressional Budget Office (CBO) analyzes federal policies that influence R&D spending in the pharmaceutical industry. The report highlights how taxes affect R&D investment incentives, underscoring the importance of structuring the tax code so that it is not biased against investment.

4 min read

While much of the tax policy now under debate aims to increase the tax burden on businesses, several policies in the newly released Republican Study Committee (RSC) budget for Fiscal Year 2022 focus on reducing the tax code’s barriers to investment and saving.

3 min read

Simplifying the R&D credit, making it more accessible for smaller firms, and ensuring full cost recovery for R&D expenses by canceling the upcoming R&D amortization are three things policymakers should consider when trying to improve the tax code for R&D.

40 min read

The corporate tax base should be reformed directly, rather than piecemeal through a complicated and burdensome separate tax applicable to a small number of companies.

5 min read

The “End Taxpayer Subsidies for Drug Ads Act” would prohibit companies from deducting the costs of prescription drug advertisements directed at the public. However, the bill’s title is a misnomer: the deduction is not a tax subsidy.

2 min read

The tax treatment of intangible assets has come into the spotlight recently with the Biden administration proposing to undo a policy adopted in 2017 to encourage intellectual property (IP) to be located in the U.S.

6 min read

Despite the coronavirus pandemic’s immense health and economic challenges, the crisis has also revealed the incredible value of innovation.

32 min read

As lawmakers evaluate how to respond to the global semiconductor shortage, they should consider allowing full cost recovery across all types of capital investment—inventories, machinery and equipment, structures, and R&D.

4 min read

R&D is more important than ever as pharmaceutical companies and governments around the world invest in coronavirus research and supply chains. But are the policies currently on the books—the R&D credit and immediate deduction for R&D expenses—the best way to encourage innovation?

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

It’s important for Poland to understand the main lesson of the Estonian approach: taxes should be designed with an overarching approach to maximize neutrality and minimize complexity and distortions. Instead of simply adopting a preference for small businesses, the Polish government should instead overhaul its corporate tax rules and truly adopt the Estonian approach to taxation.

2 min read

While a sweeping tax policy bill is unlikely in the near future, lawmakers may be able to come together on a smaller scale. Pairing better cost recovery on a permanent basis with support for vulnerable households as well as additional pandemic-related relief would help promote a more rapid return to growth and help businesses and households weather the ongoing crisis.

4 min read

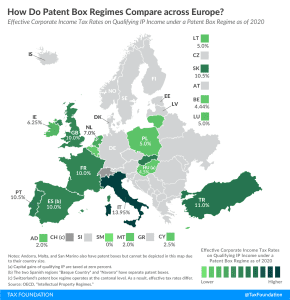

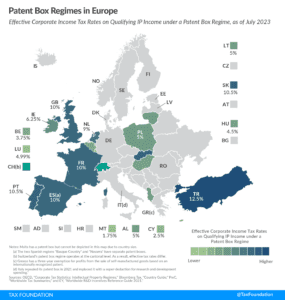

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

There has been an ongoing debate about how automation and the use of robots in the workplace has impacted workers’ wages and employment. Recently, MIT and Boston University economists examined whether tax policy favors certain forms of automation that puts workers at a competitive disadvantage.

7 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

House Republicans recently introduced HR 11, the Commitment to American GROWTH Act, outlining an alternative to Democratic presidential nominee Joe Biden’s tax vision. The proposal would address upcoming expirations of the 2017 Tax Cuts and Jobs Act (TCJA) and create or expand other tax provisions designed to boost domestic investment.

5 min read

As concern over American competitiveness and onshoring of innovative activity increases, presidential candidates and policymakers should keep in mind the tax increases scheduled to take effect in the coming years, including the amortization of R&D and phaseout of the broader expensing provisions.

3 min read

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read