Republicans Have a Chance to Empty the Attic in Upcoming Tax Debate

As we prepare for the tax code’s “move,” it’s time to start cleaning out the proverbial attic of our messy system. For the sake of our economy, moves toward growth must win the day.

As we prepare for the tax code’s “move,” it’s time to start cleaning out the proverbial attic of our messy system. For the sake of our economy, moves toward growth must win the day.

Tariffs are almost always the main issue connecting the tax reform debate with strategic competition with China. However, some provisions of the 2017 Tax Cuts and Jobs Act (TCJA) should get some of that attention, especially the 100 percent bonus depreciation and the research and development (R&D) amortization.

Fiscal pressures are likely to weigh heavily on lawmakers as they craft a tax reform package. That increased pressure could result in well-designed tax reform that prioritizes economic growth, simplicity, and stability, or it could encourage budget gimmicks and economically harmful offsets. Lawmakers should avoid the latter.

8 min read

Join hosts Kyle Hulehan and Erica York in this episode of The Deduction as they break down the US tax policy implications of Donald Trump’s next presidential term.

Artificial intelligence has become an increasingly salient issue for governments. In Europe, the AI question already has turned from how we can embrace it to how we can tax it.

Investment matters across the economy, and policymaking should reflect that.

4 min read

Broad, pro-investment tax policy matters for growth, and the US has plenty of opportunities to make improvements, particularly given the advantages our cross-Pacific rival confers on its firms.

5 min read

How does tax policy shape a nation’s competitiveness? Today, we’re diving into the showdown between the US and China, exploring how China’s enticing tax incentives pose a formidable challenge to America’s economic supremacy.

Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy.

44 min read

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Supernormal profits are an important concept, but we should be wary of analysis that both defines supernormal profits very broadly and equates all supernormal profits with monopoly profits that can be easily taxed without negative economic effects.

23 min read

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

Depending on the 2024 US election, the current corporate tax rate of 21 percent could be in for a change. See the modeling here.

4 min read

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

5 min read

A 15 percent corporate rate would be pro-growth, but it would not address the structural issues with today’s corporate tax base.

4 min read

A higher tax burden for private infrastructure investments like wireless spectrum, 5G technology, and machinery and equipment makes an existing problem worse—especially against the backdrop of outright state subsidies in countries like China.

6 min read

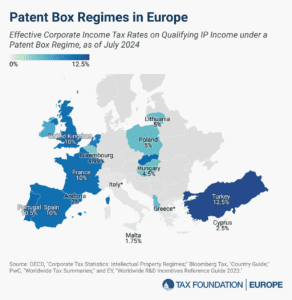

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

The Treasury Department recently touted strong business investment in the years following the pandemic-driven recession and pointed to the Biden administration’s industrial policies in the Inflation Reduction Act and CHIPS Act as key drivers.

7 min read

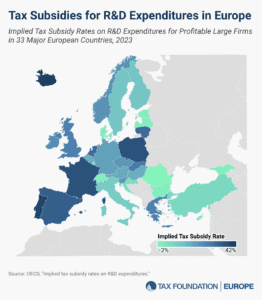

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

3 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read