Changing Tax Policy Landscape Will Worsen U.S. Competitiveness

Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and the recovery from the pandemic.

4 min read

Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and the recovery from the pandemic.

4 min read

Policymakers at all levels of government should avoid the pitfalls of incentives. Instead, they should focus on creating a more efficient, neutral, and structurally sound tax code to the benefit of all types of business investment.

6 min read

Congress should recognize that Pillar Two has significant U.S.-specific downsides, but also that it cannot unilaterally stop Pillar Two from taking effect. Instead, it should carefully consider a policy response for the next Congress, when a variety of forces are likely to compel it to act.

7 min read

A growing international tax agreement known as Pillar Two presents two new threats to the US tax base: potential lost revenue and limitations on Congress’s ability to set its own tax policy.

39 min read

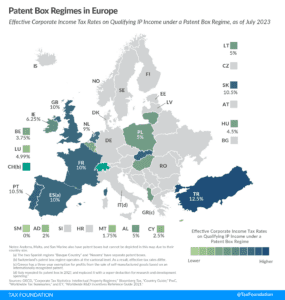

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

Even in the face of a global minimum tax, Congress still has a chance to develop a strategic approach in support of U.S. investment and innovation.

Permanent full expensing is an efficient and neutral tax policy that will allow markets to allocate private investment effectively while moving the economy towards the climate goals of the EU.

33 min read

As predicted, the Inflation Reduction Act’s misguided price-setting policy is already discouraging drug development. Rather than double down on it, as President Biden proposes doing in his budget, lawmakers ought to restore incentives to invest in the United States.

5 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

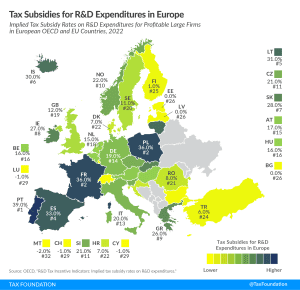

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

3 min read

Instead of such a complex and inefficient system, policymakers should move to full expensing as part of the effort to build.

3 min read

Spreading deductions for research investments across five years instead of one is an innovation killer.

Lawmakers should recognize both the growing importance of business R&D and the need to support it through a commonsense tax policy, namely a return to full and immediate expensing for R&D.

6 min read

The tax treatment of research and development (R&D) expenses is one of the biggest issues facing Congress as the year winds down.

5 min read

Two weeks after the 2022 midterm elections, it’s becoming clearer where tax policy may be headed for the rest of the year and into 2023. In the short term, Congress must deal with tax extenders and expiring business tax provisions that may undermine the economy.

5 min read