All Related Articles

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read

A Preliminary Look at 2018 Tax Data

Initial 2018 IRS tax return data shows that the TCJA expanded the use of several credits and deductions, made the standard deduction more favorable than itemizing, reduced tax refunds, and lowered taxes for most Americans.

4 min read

State Tax Changes as of July 1, 2019

15 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

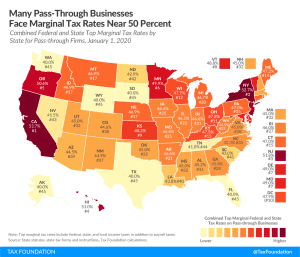

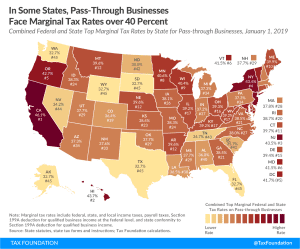

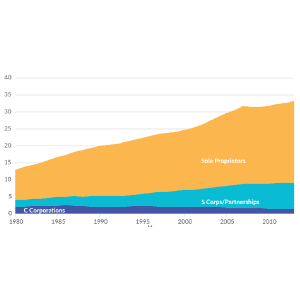

Marginal Tax Rates for Pass-through Businesses Vary by State

Pass-through businesses are now the dominant business form in the U.S., making up more than half of the private sector workforce in every state. Federal taxes on income set a minimum tax rate for pass throughs, but marginal rates for pass throughs vary based on how states tax individual income.

3 min read

Pass-Through Businesses Q&A

Pass-through businesses are the dominant business structure in America. Pass throughs file more tax returns and report more business income than C corporations. Pass-through businesses are not subject to the corporate income tax, but instead report their income on the individual income tax returns of owners. This blog will address some frequently asked questions about pass-through structure and taxation.

4 min read

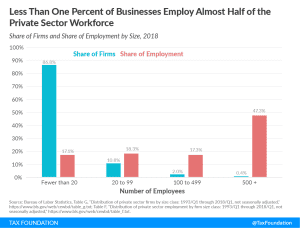

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

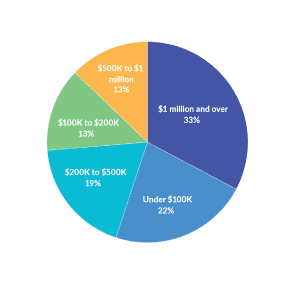

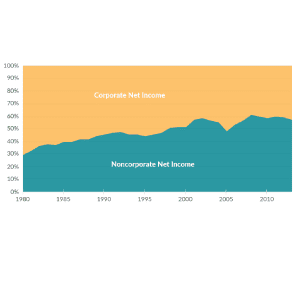

Corporate and Pass-through Business Income and Returns Since 1980

More business income is reported on individual tax returns than corporate returns. The U.S. now has fewer corporations and more individually owned businesses. Corporations make up less than 5 percent of businesses but earn 60 percent of revenues.

3 min read

Recapping the 2019 Arkansas Tax Reform

3 min read

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min readToward a State of Conformity: State Tax Codes a Year After Federal Tax Reform

States incorporate provisions of the federal tax code into their own codes in varying degrees, meaning that federal tax reform has implications for state revenue beyond any broader economic effects of tax reform.

73 min read

Reforming the Pass-Through Deduction

Here’s how the new pass-through deduction works and how it can be reformed to be less complex, less prone to abuse, more neutral, and more economically efficient.

49 min read

Will Illinois Double Down on High Taxes?

Amending the Illinois constitution and adopting a graduated-rate income tax cannot solve the state’s fundamental problems. Instead, it doubles down on an already uncompetitive tax code.

16 min read