Does Your State Have a Marriage Penalty?

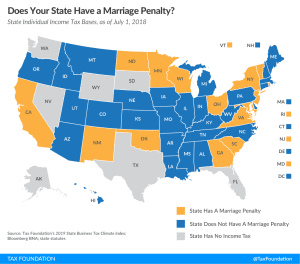

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers.

2 min read

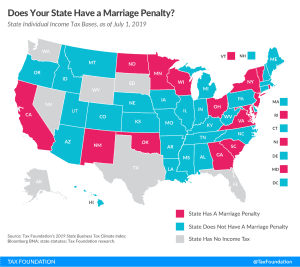

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers.

2 min read

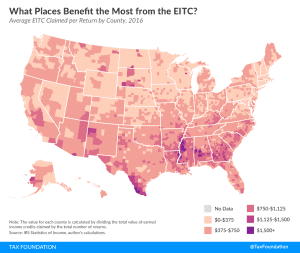

In many cases, when two single workers combine their incomes and file jointly, the progressive tax system penalizes the secondary earner by subjecting their wages to a higher marginal tax rate.

25 min read

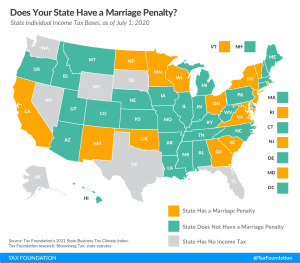

A marriage penalty is when married couples filing jointly face a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

2 min read

The marriage penalty and the marriage bonus are each ways that the income tax code violates the principle of neutrality and affects taxpayer behavior. Here’s how each works and why they deserve attention.

13 min read