Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read

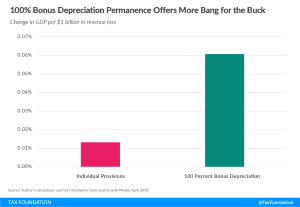

In the long run, permanent full expensing produces about 4.5 times more GDP growth per dollar of revenue than making individual TCJA provisions permanent.

2 min read

The Tax Cuts and Jobs Act made significant progress in improving businesses’ ability to recover the cost of making investments in the United States by enacting 100 percent bonus depreciation.

11 min read

Cutting the corporate tax rate improves the United States’ international tax competitiveness, incentives new investment and benefits both old & new capital.

3 min read

How capital assets are accounted for in the tax code dramatically affects what is defined as taxable income and, thereby, directly influences the cost of capital. The higher the cost, the less capital is formed, and the slower the economy will grow.

2 min read