Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min readLearn more about budget reconciliation and explore our research and analysis of the latest budget reconciliation tax proposals. Our experts explain what budget reconciliation is, how it works, and the role that politics will play in it for the 119th Congress as well as President Trump‘s policy agenda. You can also launch our Reconciliation Tracker

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

As the current tax package stands, the House’s use of temporary policy is leaving most of the economic growth opportunities on the table.

2 min read

Senate Republicans have advanced legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation put forward by House Republicans.

8 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

As lawmakers work through the reconciliation process, permanently enacting improvements to deductions for capital investment and research and development (R&D) costs will create an economically powerful package.

8 min read

If Congress allows the Tax Cuts and Jobs Act (TCJA) to expire as scheduled, most aspects of the individual income tax would undergo substantial changes, resulting in more than 62 percent of tax filers experiencing tax increases in 2026.

3 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

Tax simplification has two aspects. The first is a code without a mess of targeted provisions for various social policy goals. The second is a code with provisions that are simple and easy to comply with. The bill succeeds at the first, but fails at the second.

7 min read

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

If lawmakers are serious about pro-growth policies and fiscal responsibility, they will need to put policies forward that achieve those goals. Simply adjusting the baseline doesn’t reduce actual deficits in the coming years.

7 min read

Lawmakers should prioritize pro-growth tax policies and use the least economically damaging offsets to make the legislation fiscally responsible. If lawmakers choose to use C-SALT, they should carefully consider the economic trade-off with permanent, pro-growth tax cuts that support investment and innovation in the US.

7 min read

Fiscal pressures are likely to weigh heavily on lawmakers as they craft a tax reform package. That increased pressure could result in well-designed tax reform that prioritizes economic growth, simplicity, and stability, or it could encourage budget gimmicks and economically harmful offsets. Lawmakers should avoid the latter.

8 min read

What happens to your taxes when the Tax Cuts and Jobs Act expires on January 1, 2026? In this episode, we explore the potential tax hikes facing millions of Americans and the debate over measuring the budgetary impacts of extending tax cuts.

In a perilous economic and fiscal environment, with instability created by Trump’s trade war and publicly held debt on track to surpass the highest levels ever recorded within five years, a lot rides on how Republicans navigate tax and spending reforms in reconciliation.

6 min read

While capping C-SALT has superficial appeal in perceived parity with personal limits, it rests on flawed assumptions about the nature of individual and corporate income taxes.

7 min read

The House Budget Committee has released a budget resolution that specifies large reductions in both taxes and spending over the next decade, paving the way to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially cut other taxes.

6 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

What will the future of tax policy look like? In this episode, we dive into the critical challenges and opportunities looming on the horizon, especially with major tax cuts set to expire, which could increase taxes for 62 percent of filers.

Republican policymakers in Congress are considering options to raise revenue as part of their expected legislative package in 2025. One such option involves raising the tax rate on university endowments first put in place as part of the TCJA in 2017.

4 min read

Tax policy is almost always a balancing act between the tax rate – how much someone pays – and the tax base – who or what is being taxed.

Due to the House Build Back Better tax plan’s economically costly and inefficient tax increases, our analysis finds that long-run GDP would drop by a little over $1 for every $1 in new tax revenue.

6 min read

Infrastructure has made its way across the finish line, but the tax debate is far from over on Capitol Hill. Senior policy analyst Garrett Watson joins host Jesse Solis to walk us through the latest iteration of Democrats’ trillion-dollar reconciliation package and the myriad tax changes that are being proposed to finance this deal.

The most recent versions of President Biden’s Build Back Better plan are improvements on the original proposal, but would still reduce economic growth and average after-tax incomes for the top 80 percent of earners in the long run.

7 min read

The nicotine tax proposal in the Build Back Better Act neglects sound excise tax policy design and by doing so risks harming public health. Lawmakers should reconsider this approach to nicotine taxation.

8 min read

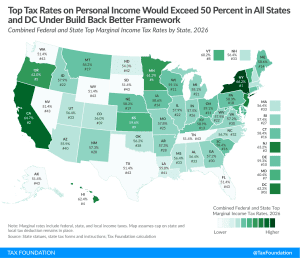

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD).

2 min read

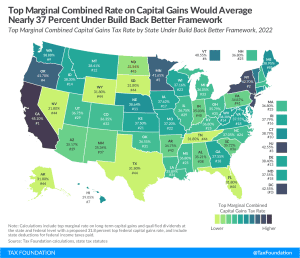

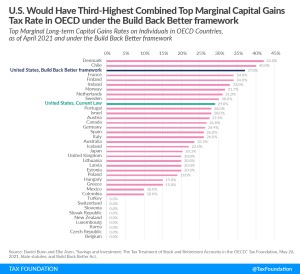

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read

Under the new Build Back Better framework, the United States would tax capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

1 min read

Congress is debating new ways to raise revenue that would make the tax code more complex and more difficult to administer. The new proposals—imposing an alternative minimum tax on corporate book income, applying an excise tax on stock buybacks, and, at one point this week, a tax on unrealized capital gains for billionaires—are unreliable and highly complex ways to raise revenue.

10 min read

President Biden and Congressional Democrats introduced a scaled-back proposal of their reconciliation package, with House leadership saying they hope to vote on this new trillion-dollar package ASAP. We talk through what made it into the deal, what was cut, and what the impact of these tax changes would be.

When examining how tax policy impacts the economy, researchers typically look at labor supply and investment responses. One other channel through which taxes impact the economy has been less studied: innovation.

3 min read

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

The legislation put forward by Democratic members of the House of Representatives would reverse many of the 2017 reforms while increasing burdens on businesses and workers.

2 min read

With corporate and individual rate hikes potentially out of the Build Back Better (BBB) reconciliation package, lawmakers are weighing alternative options to raise revenue. Rather than come up with untested proposals and complicated changes to the tax base, they should prioritize options that raise revenue while improving the structure of the tax code.

4 min read

Raising taxes on stock-based compensation through a book income tax will disadvantage this form of compensation and produce more complexity in the tax system without providing benefits to workers.

5 min read

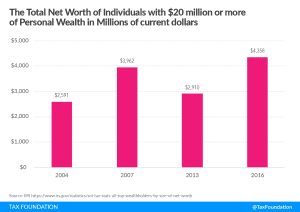

One has to wonder how stable or sustainable the Democrats’ spending program can be if it must rely so heavily on the taxes paid by such a small number of taxpayers as in the top 1 percent.

5 min read

Reducing the tax gap is a good idea, but the reporting requirements for financial institutions could be better-targeted at the problem at hand.

4 min read

President Biden expanded and fundamentally changed the Child Tax Credit (CTC) for one year in the American Rescue Plan (ARP) passed in March 2021. Policymakers are now deciding the future of the expansion as part of the proposed reconciliation package, but a wide range of estimates for the effects of a permanent expansion is confusing the debate.

7 min read

Under the House Ways and Means plan to raise taxes on corporations and individuals, the integrated tax rate on corporate income would rise to the third highest in the OECD. To reduce this burden, policymakers could explore integrating the individual and corporate tax systems.

8 min read

In an effort to raise roughly $100 billion, the House proposal would double cigarette taxes and increase all other tobacco and nicotine taxes to comparable rates—a strategy with severe unintended consequences.

5 min read

Tax Foundation testimony at the Joint Economic Committee hearing on the revenue provisions in the Build Back Better Act and related analysis on their estimated impact.