Wyden’s Energy Tax Proposal a Mixed Bag

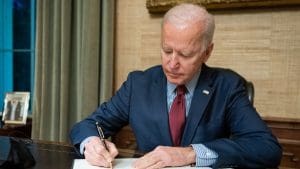

As the Biden administration turns toward infrastructure, Sen. Ron Wyden (D-Or.) has suggested including reforms to the way the tax code subsidizes energy production in such a package, eliminating 44 “tax breaks” for various activities in the energy sector and replacing them with only three.

3 min read