All Related Articles

Policymakers Offer Proposals to Fix Three Upcoming Tax Changes

Three upcoming tax law changes scheduled by the 2017 Tax Cuts and Jobs Act (TCJA) to help offset its revenue losses would be canceled by proposed legislation that would prevent the tax treatment of investment from worsening over the coming years.

4 min read

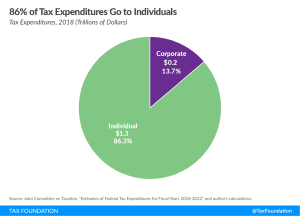

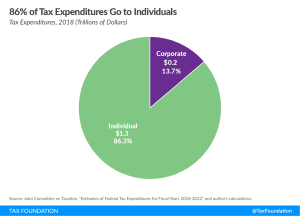

U.S. Corporate Tax Expenditures and Effective Tax Rates in Line with OECD Peers

Last week, an analysis by Reuters suggested that U.S. firms pay less income tax than foreign competitors, in part because “the U.S. tax code is unusually generous with tax breaks and deductions,” also known as corporate tax expenditures. However, the Reuters analysis is at odds with other data and studies indicating that U.S. corporate tax expenditures and effective tax rates are about on par with those in peer countries in the OECD.

3 min read

How the Tax Code Handles Inflation (and How It Doesn’t)

While parts of the U.S. tax code can handle inflation, full expensing of capital investment would be a major improvement along these lines.

5 min read

Expensing Is Infrastructure, Too

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

Combined Effect of a Higher Corporate Rate and Permanent Bonus Depreciation

The negative effects of President Biden’s proposed 28 percent corporate income tax rate could be tempered by improving how the corporate income tax base treats investment expenses.

4 min read

Two Important Issues that Must Be Resolved in “Global Tax Reform”

If the U.S. is suggesting a 15 percent effective rate as the minimum acceptable rate for a global agreement, then the tax bases of the various minimum taxes adopted as part of the agreement should be aligned to minimize complexities and unintended consequences.

5 min read

Tax Policy Ideas in the Republican Study Committee Budget

While much of the tax policy now under debate aims to increase the tax burden on businesses, several policies in the newly released Republican Study Committee (RSC) budget for Fiscal Year 2022 focus on reducing the tax code’s barriers to investment and saving.

3 min read

Tax Policy Lessons from Down Under

This week the Australian government released its latest budget proposal and two policies that stand out in its fiscal response to the pandemic should be helpful as the economic engine of the country turns back on. The first is full expensing for some investments and the second is the introduction of a loss carryback provision. The new budget takes both these temporary policies and extends them into 2023.

2 min read

Reviewing Options to Raise Tax Revenue and the Trade-offs for Economic Growth and Progressivity

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read

Providing Full Cost Recovery for Investment and Lowering Taxes on Firms Are Best Options for Boosting Growth

As policymakers consider tax options to boost the U.S. economy’s long-run economic growth, they should consider reforms that would increase growth the most while minimizing forgone tax revenue.

4 min read

IMF Tax Proposals: Shrink Inequality or Sink Post-Pandemic Recovery?

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

Leveling Up: The UK’s Super-Deduction and its Regional Divide

As part of the 2021 Budget, the UK introduced a 130 percent super-deduction for plant and equipment for the next two years, meaning that businesses can take a deduction amounting to 130 percent of the costs in the year the investment is made.

4 min read

Capital Cost Recovery across the OECD, 2021

The ongoing pandemic has once again highlighted the importance of investment. To address the economic fallout of the pandemic, several OECD countries have temporarily accelerated depreciation schedules for various assets.

31 min read

Marginal Effective Tax Rates and the 2021 UK Budget

The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to 25 percent in 2023. These policies have differential impacts on marginal effective tax rates for different assets, implying investment incentives will not be uniform.

15 min read

Tax Policy Improvements Needed to Help Industries through the Semiconductor Shortage

As lawmakers evaluate how to respond to the global semiconductor shortage, they should consider allowing full cost recovery across all types of capital investment—inventories, machinery and equipment, structures, and R&D.

4 min read

Wyden’s Energy Tax Proposal a Mixed Bag

As the Biden administration turns toward infrastructure, Sen. Ron Wyden (D-Or.) has suggested including reforms to the way the tax code subsidizes energy production in such a package, eliminating 44 “tax breaks” for various activities in the energy sector and replacing them with only three.

3 min read

An Investment Boost in the UK’s 2021 Budget

The UK’s Chancellor of the Exchequer Rishi Sunak released the 2021 budget, and most important for near-term growth is the significant boost to capital allowances.

5 min read

The UK Should Not Ignore Problems with its Corporate Tax Base

While the UK is looking at ways to raise tax revenue to cover the revenue shortfalls and additional spending resulting from the COVID-19 pandemic, short- as well as long-term, investment will be crucial in getting the economy back on track and ensuring economic growth.

3 min read

Evaluating Proposals to Increase the Corporate Tax Rate and Levy a Minimum Tax on Corporate Book Income

President Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations, to raise revenue for new spending programs. Our new modeling analyzes the economic, revenue, and distributional impact of these proposals.

46 min read