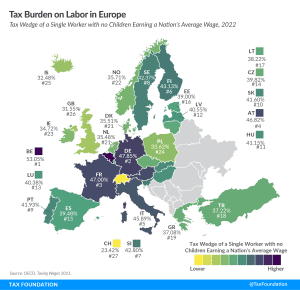

Tax Burden on Labor in Europe, 2022

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

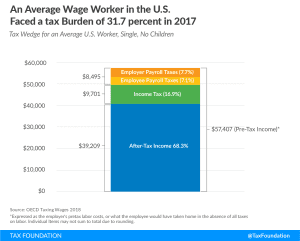

Before accounting for state and local sales taxes, the tax burden that a single average wage earner faces in the U.S. is 31.7 percent of pretax earnings, amounting to $18,198 in taxes in 2017.

18 min read

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

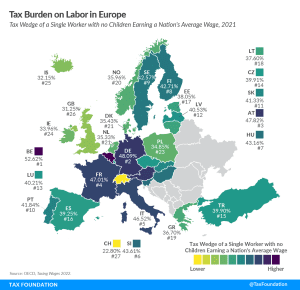

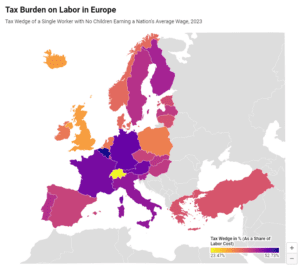

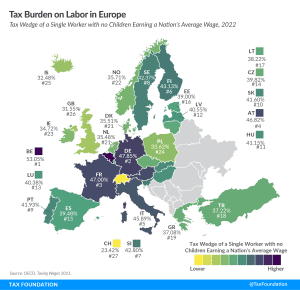

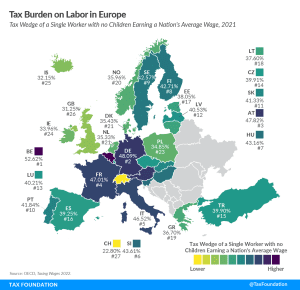

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

Smart tax policy takes into account how policy changes impact real people. Understanding who bears the burden of the corporate tax and the effects of a higher rate are essential to sound policymaking.

4 min read

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

Lawmakers should simplify the tax code so that taxpayers can understand the laws and the IRS can administer them with minimum cost and frustration.

Montana Policymakers should pursue principled property tax reform that benefits all property owners without creating market distortions or unfairly shifting the tax burden.

5 min read

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

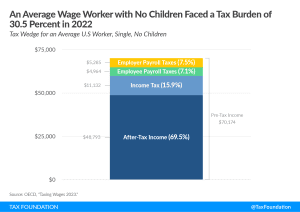

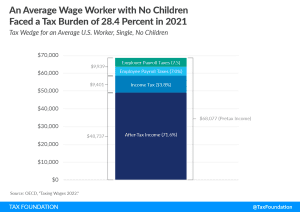

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

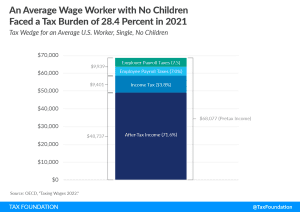

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay nearly 30 percent of their wages in taxes.

4 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read