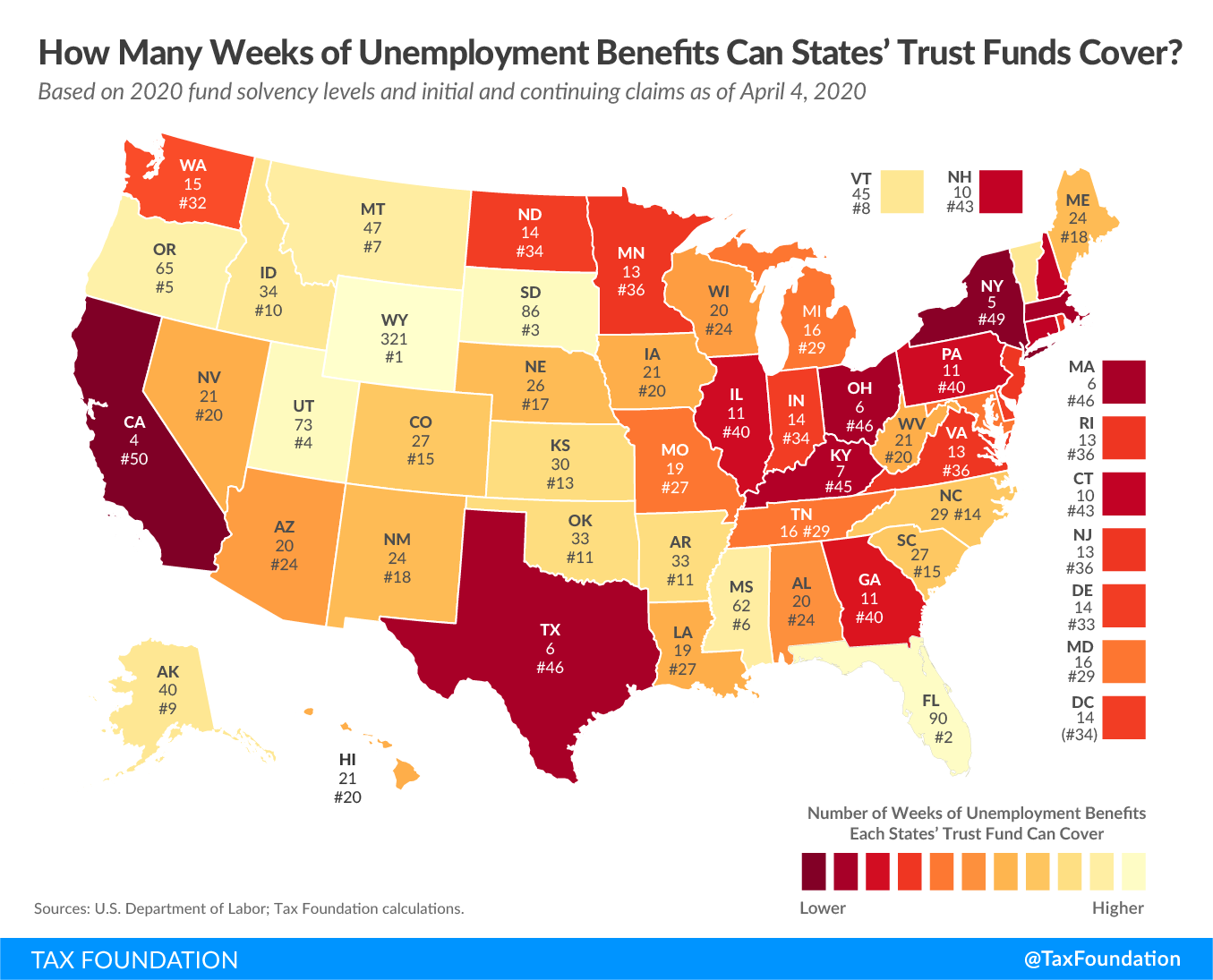

Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation claims that have already come in since the start of the COVID-19 pandemic—including those they’ve already begun to pay out. California is in the worst shape, with only about 26 days’ worth of funding in its unemployment compensation trust fund. Overall, only six states would be able to pay out benefits for a year or more based on current unemployment insurance (UI) benefit claims levels.

The U.S. Department of Labor assesses the health of state UI funds with several measures. One is the Reserve Ratio, which looks at the trust fund balance as a percentage of a state’s total annual wages. Minimum adequate solvency entering a recession is calculated by dividing the Reserve Ratio by what is called the Average Benefit Cost Rate, which represents the average of the three highest rates of benefits the state had to pay out (as a percentage of state wages) over the past 20 years. If this yields a solvency level of 1.0 or greater, the state is deemed to have adequate UI funding to weather a recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. .

Unfortunately, UI claims during the current crisis are dramatically higher than they were during the Great Recession. Initial and continuing claims for the week ending April 4 (most recent data) stand at 14.38 million—283 percent of averages for the three years used to calculate solvency levels.

It is possible to take states’ reported solvency levels at the start of the year, along with claims data for each state’s own worst three years, and match those against the most recent initial and continuing claims data to obtain an estimate of how many weeks of benefits a state could pay out based on those who have applied for or are currently receiving unemployment insurance benefits.

If anything, this estimate is generous, as it only takes into account claims filed through April 4 (due to the timing of data releases) and does not adjust for the degree to which these states’ funds have already been drawn down over the past two weeks.

When states exhaust their trust funds, they must look to other sources of funding, either within their own state budgets or through loans from the federal government, which must ultimately be paid back—in some cases with interest.

The 31 states with solvency levels of 1.0 or higher may borrow without interest, at least initially; states with lower solvency levels will incur interest payments. Eventually, should states take too long to repay these loans, technically called Title XII advances, in-state employers will face higher federal unemployment insurance taxes to compensate for their state’s indebtedness.

The federal government, as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, is providing federal funding to incentivize states to end one-week waiting periods, providing an additional $600 a week to each state unemployment insurance beneficiary, and offering extended benefits once state benefits run out—but states must still come up with the funding for regular benefits, and unfortunately, many are woefully unprepared to do so.

| Based on 2020 fund solvency levels and initial and continuing claims as of April 4, 2020 | |

|---|---|

| State | Weeks |

| Alabama | 20 |

| Alaska | 40 |

| Arizona | 20 |

| Arkansas | 33 |

| California | 4 |

| Colorado | 27 |

| Connecticut | 10 |

| Delaware | 14 |

| District of Columbia | 14 |

| Florida | 90 |

| Georgia | 11 |

| Hawaii | 21 |

| Idaho | 34 |

| Illinois | 11 |

| Indiana | 14 |

| Iowa | 21 |

| Kansas | 30 |

| Kentucky | 7 |

| Louisiana | 19 |

| Maine | 24 |

| Maryland | 16 |

| Massachusetts | 6 |

| Michigan | 16 |

| Minnesota | 13 |

| Mississippi | 62 |

| Missouri | 19 |

| Montana | 47 |

| Nebraska | 26 |

| Nevada | 21 |

| New Hampshire | 10 |

| New Jersey | 13 |

| New Mexico | 24 |

| New York | 5 |

| North Carolina | 29 |

| North Dakota | 14 |

| Ohio | 6 |

| Oklahoma | 33 |

| Oregon | 65 |

| Pennsylvania | 11 |

| Rhode Island | 13 |

| South Carolina | 27 |

| South Dakota | 86 |

| Tennessee | 16 |

| Texas | 6 |

| Utah | 73 |

| Vermont | 45 |

| Virginia | 13 |

| Washington | 15 |

| West Virginia | 21 |

| Wisconsin | 20 |

| Wyoming | 321 |

|

Sources: U.S. Department of Labor; Tax Foundation calculations. |

|

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe