What the OECD’s Pillar Two Impact Assessment Misses

The process leading to the global minimum tax has been messy, and the mess will likely continue for years to come. New revenues are hardly a salve for the setback they represent.

7 min read

The process leading to the global minimum tax has been messy, and the mess will likely continue for years to come. New revenues are hardly a salve for the setback they represent.

7 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read

Spreading deductions for research investments across five years instead of one is an innovation killer.

On the heels of adopting one of the most comprehensive state tax reform packages in years, Iowa lawmakers are back in Des Moines with property tax relief in their sights. But while the issue is worthy of their attention, House File 1 (HF 1) as currently drafted misses the mark.

4 min read

Before EU policymakers rush to implement massive reforms, they should remember the goals of the Single Market, its international limitations, and the role of tax policy.

4 min read

By shifting to a flat income tax, Georgia has already made an important commitment to tax competitiveness. Although the state’s top rate threshold is already very low, a true single-rate income tax will help protect taxpayers from inflation-related tax increases and provide a buffer against rising tax rates in the future. To combine responsible rate reductions with these benefits, Georgia should create tax triggers that empower the state to keep pace with its competition.

3 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

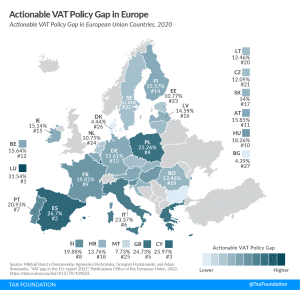

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

Lawmakers should use the most comprehensive analytical tools available to them—like dynamic scoring—to make informed decisions about policy changes.

5 min read