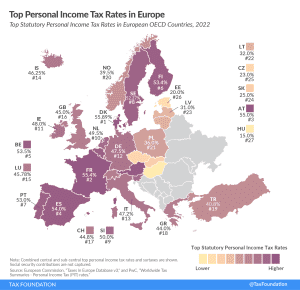

Top Personal Income Tax Rates in Europe, 2023

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

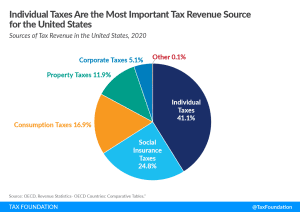

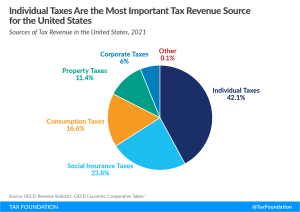

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

A growing number of cities, in red states like Arkansas and Texas, blue states like California and New Jersey, and purple states like Georgia and Nevada, have pursued streaming taxes in recent years.

7 min read

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

California is losing tax revenue while consumers turn to cross-border purchases or, often, illicit trade of flavored cigarettes, which makes everyone worse off.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

With other states upping their game to attract ever-more-mobile people and businesses, lawmakers and the governor are not content to leave Tennessee’s business taxes in their current, uncompetitive form.

7 min read

Most states avoid municipal income taxes for good reason. These taxes are more volatile and less economically competitive than other forms of taxation available to local governments, and add substantial complexity for governments and taxpayers alike.

23 min read

Levied in thousands of cities, counties, school districts, and other localities, local income taxes are often used to either lower other taxes (like property taxes) or raise more revenue for local services. While they may make sense on paper, local income taxes come with more challenges than other local revenue sources.

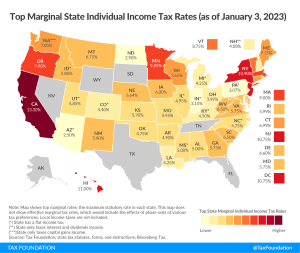

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read