All Related Articles

9205 Results

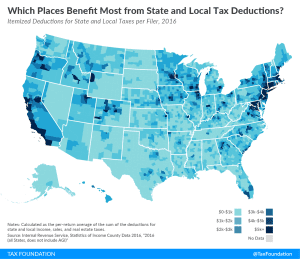

The Benefits of the State and Local Tax Deduction by County

Do taxpayers in your area rely heavily on state and local tax deductions? See how the Tax Cuts and Jobs Act tax plan may impact taxpayers in your county.

2 min read