All Related Articles

9205 Results

The Economics of Stock Buybacks

Stock buybacks are readily visible, and unfortunately some have misunderstood stock buybacks to be taking place at the expense of long-term investments.

17 min read

Cost Recovery Treatment Short of Full Expensing Creates A Drag on Economic Growth

Full expensing is a key driver of future economic growth, and can have a larger pro-growth effect per dollar of revenue forgone than cutting tax rates.

3 min read

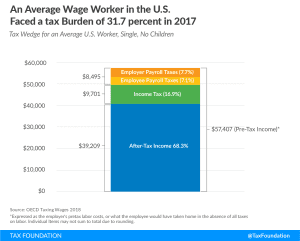

A Comparison of the Tax Burden on Labor in the OECD, 2018

Before accounting for state and local sales taxes, the tax burden that a single average wage earner faces in the U.S. is 31.7 percent of pretax earnings, amounting to $18,198 in taxes in 2017.

18 min read