All Related Articles

Pass-Through Businesses Q&A

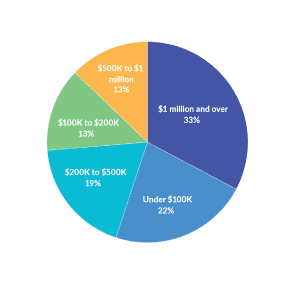

Pass-through businesses are the dominant business structure in America. Pass throughs file more tax returns and report more business income than C corporations. Pass-through businesses are not subject to the corporate income tax, but instead report their income on the individual income tax returns of owners. This blog will address some frequently asked questions about pass-through structure and taxation.

4 min read

New Details on the Austrian Tax Reform Plan

14 min read

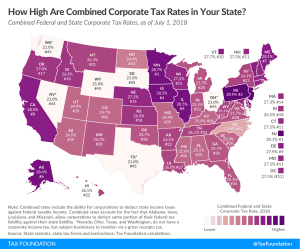

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

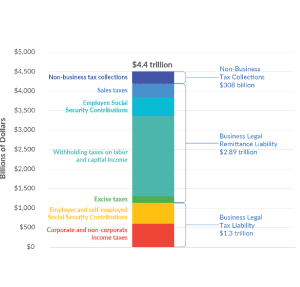

U.S. Businesses Pay or Remit 93 Percent of All Taxes Collected in America

Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

5 min read

Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read