All Related Articles

9205 Results

Taxes on Capital Income Are More Than Just the Corporate Income Tax

The United States’ statutory corporate income tax rate is now more aligned with the rates of other nations . However, taxes on capital income, or corporate investment, are more than just the corporate income tax. Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

3 min read

Reliance on Consumption Taxes in Europe

2 min read

The Tax Gap Tops $500 Billion a Year

4 min read

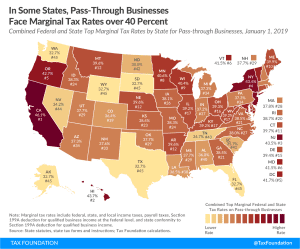

Marginal Tax Rates for Pass-through Businesses Vary by State

Pass-through businesses are now the dominant business form in the U.S., making up more than half of the private sector workforce in every state. Federal taxes on income set a minimum tax rate for pass throughs, but marginal rates for pass throughs vary based on how states tax individual income.

3 min read