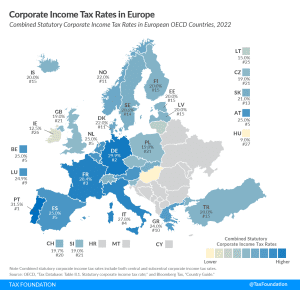

Corporate Income Tax Rates in Europe, 2022

Portugal, Germany and France have the highest corporate tax rates in Europe. How does your country compare?

2 min read

Portugal, Germany and France have the highest corporate tax rates in Europe. How does your country compare?

2 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

The expanded Child Tax Credit from the American Rescue Plan was touted as a once-in-a-lifetime achievement toward reducing child poverty. But it was passed as a temporary tax measure. Temporary tax policy makes tax filing confusing, and the IRS has shown that it isn’t able to keep pace with being a social administrator and a tax collector. We discuss what taxpayers need to know about the ever-changing Child Tax Credit and how it may impact taxpayers this spring.

A group of lawmakers in Ohio have proposed to repeal the state’s gross receipt tax (GRT), also known as the commercial activity tax (CAT).

5 min read

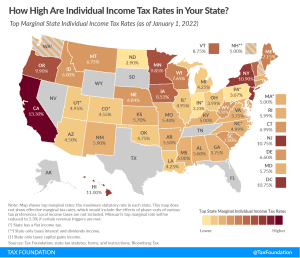

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min read

Alabama lawmakers are acting to ensure that federal relief from the American Rescue Plan Act does not increase tax liabilities in the state.

4 min readDesigning tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Since 2018, 30 states and the District and Columbia have legalized and imposed taxes on sports betting. States that have yet to legalize, but which may do so, should pay attention to the impact of tax design in states that already have legal and taxed sports betting—specifically tax base design.

8 min read

Not only is the tax inequitable and inefficient, it also could be what drives businesses and remote workers into another state.

7 min read