All Related Articles

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

New York and New Jersey Consider Financial Transaction Taxes

Seeking new sources of funding, New York and New Jersey—two states at the heart of global financial markets—are considering financial transaction taxes.

5 min read

1980s Tax Reform, Cost Recovery, and the Real Estate Industry: Lessons for Today

The Tax Reform Act of 1986 extended depreciation schedules for both commercial and noncommercial of real estate, reducing the attractiveness of those investments.

21 min read

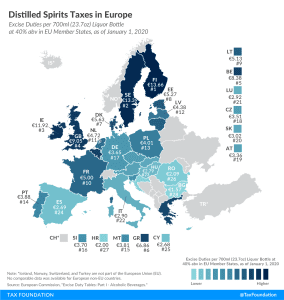

Distilled Spirits Taxes in Europe

2 min read

Austria Is Mulling an Allowance for Corporate Equity

While not a short-term measure to alleviate the economic losses resulting from the current crisis, experience from other countries has shown that a tax allowance for corporate equity can be a sensible long-term policy that can strengthen Austria’s investment environment and improve financial stability.

6 min read

The History of Excess Profits Taxes Not as Effective or Harmless as Today’s Advocates Portray

Today’s advocates would do well to study the history of excess profits taxes before overselling these taxes as a solution to the COVID-19 crisis.

2 min read

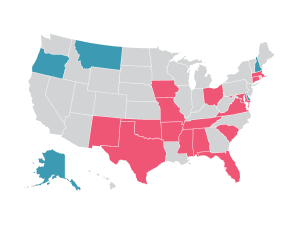

Sales Tax Holidays by State, 2020

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

The New EU Budget is Light on Details of Tax Proposals

The European Council recently agreed on a new multiannual budget and a recovery program, which sets EU budget levels for 2021-2027 totals €1 trillion (US $1.2 trillion). The lack of details on the various tax proposals and the eventual need for revenue sources to finance new EU debt mean there is a lot of work left for policymakers in Brussels to do.

4 min read