All Related Articles

1305 Results

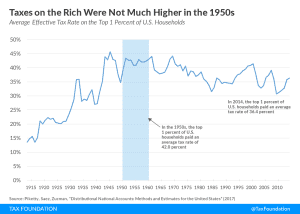

Taxes on the Rich Were Not That Much Higher in the 1950s

The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards. In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent.

4 min read

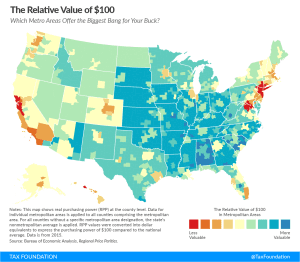

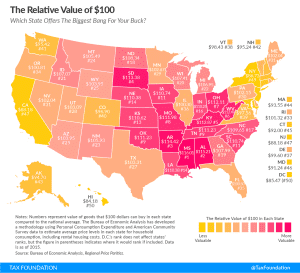

Real Value of $100 by State, 2017

Prices for the same goods are often much cheaper in some states than others. Check out our new map to see what the real value of $100 is in your state.

4 min read

Sales Tax Holidays by State, 2017

Sales tax holidays have enjoyed political success, but rather than providing a valuable tax cut or a boost to the economy, they impose serious costs on consumers and businesses without providing offsetting benefits.

43 min read