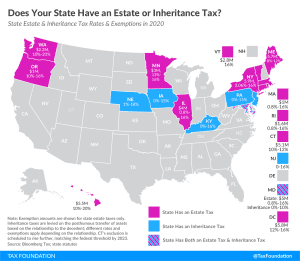

Estate and Inheritance Taxes by State, 2020

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read

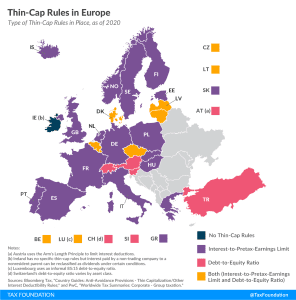

To discourage a certain form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

4 min read

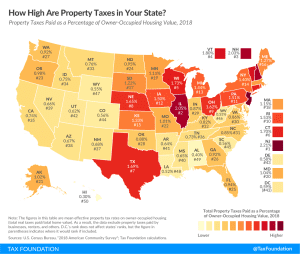

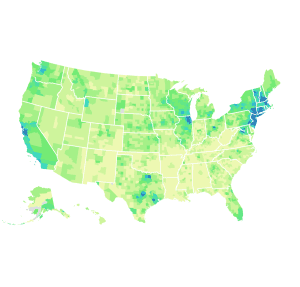

New Jersey has the highest effective rate on owner-occupied property at 2.21 percent, followed closely by Illinois (2.05 percent) and New Hampshire (2.03 percent).

2 min read

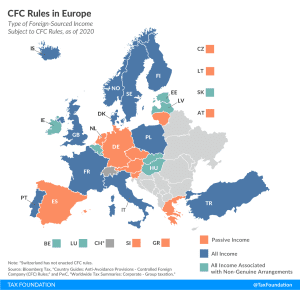

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one known as Controlled Foreign Corporation (CFC) rules.

5 min read

The five counties with the highest median property tax payments are all located near New York City and have bills exceeding $10,000.

3 min read

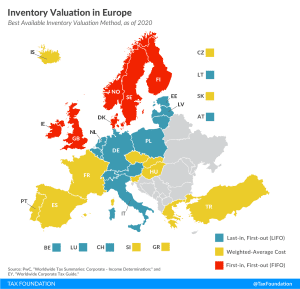

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

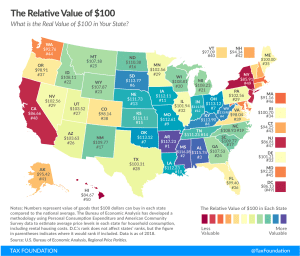

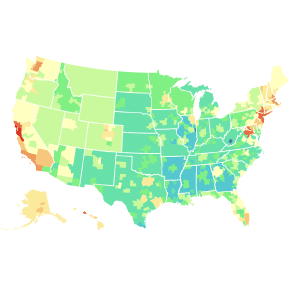

California is home to 7 of the 10 most expensive metro areas in America. See what’s the real value of $100 in your metro area with our new purchasing power map.

4 min read

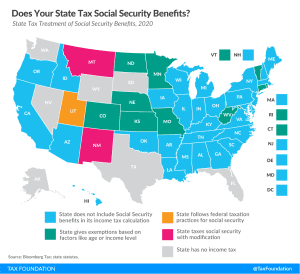

The question, “Does my state tax Social Security benefits?” may be simple enough, but the answer includes a lot of nuance. Many states have unique and specific provisions regarding the taxation of Social Security benefits, which can be broken into a few broad categories.

3 min read

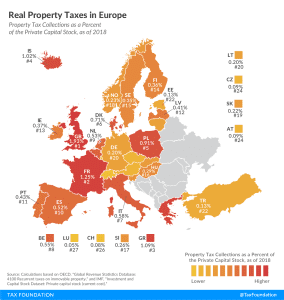

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read