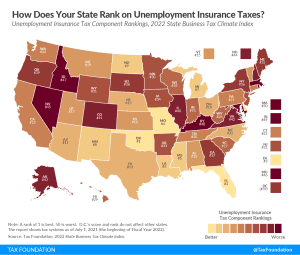

Ranking Unemployment Insurance Taxes on Our 2022 State Business Tax Climate Index

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

The ongoing economic uncertainty from the COVID-19 pandemic, supply chain disruptions, and current inflationary pressures have highlighted the importance of investment.

33 min read

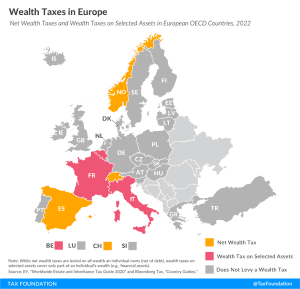

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

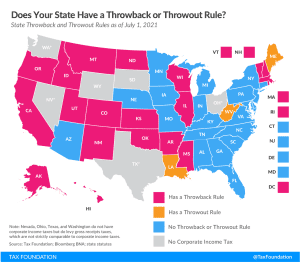

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

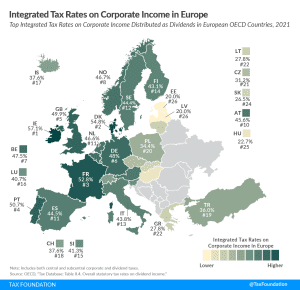

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

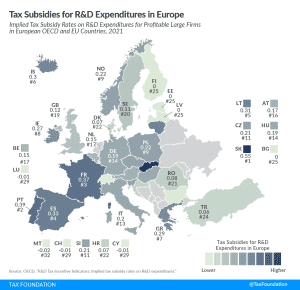

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

3 min read