Trump Tariffs: The Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

32 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

32 min read

Pairing permanent TCJA individual tax cuts with new limits on business SALT deductions would shrink the economy, reduce American incomes, and increase the federal budget deficit, undermining the policy goals of TCJA permanence.

3 min read

The Trump administration advocates an “energy dominance” agenda to boost US energy production and lower costs. Its tariff agenda runs directly counter to it.

5 min read

What happens when the country’s most important retirement program runs out of money? Social Security faces a funding crisis by 2035. We unpack how the system works, why it’s in trouble, and what fixes could keep it afloat.

Catastrophic rhetoric about US manufacturing is not justified. The tariffs are extremely counterproductive. Still, all is not well in the US manufacturing sector. What should we do?

7 min read

The economic literature overwhelmingly suggests that an income tax increase of this magnitude would negatively affect economic growth and opportunity in Rhode Island.

As Congress debates expensing and other policies impacting business investment, lawmakers should consider the importance of business investment in research and development (R&D) as a driver for economic growth. Recent studies suggest that the economic benefits of R&D spending are even greater than previously understood.

7 min read

The tariff policies already in effect threaten to offset the benefits of the promised tax cuts.

2 min read

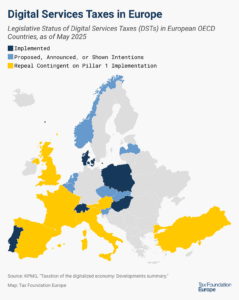

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

On April 10, the House adopted the Senate’s amended version of the budget resolution, which allows $5.3 trillion in deficit-financed tax cuts.

9 min read