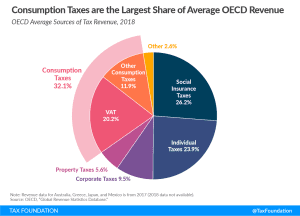

The Three Basic Tax Types

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.