All Related Articles

Challenges for Transfer Pricing in an Economic Downturn

Transfer pricing rules are under stress given the current economic crisis. The OECD should provide transfer pricing guidance during the coronavirus crisis.

13 min read

Weighing the Benefits of Permitting Business Credit Cashouts in Phase 4 Economic Relief

As lawmakers explore options for “Phase 4” coronavirus relief legislation, one idea that has received renewed attention is allowing businesses to cash out business tax credits. This proposal would be strengthened by also permitting acceleration of firms’ accrued net operating loss (NOL) deductions and designing the proposal so that firms can quickly convert these tax assets into cash.

4 min read

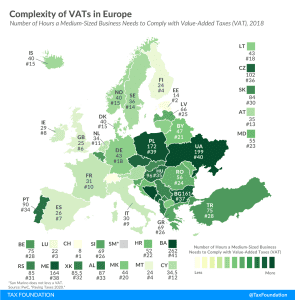

Germany Adopts a Temporary VAT Cut

Tax policy responses to the pandemic should be designed to provide immediate support while paving the way to recovery. A temporary VAT rate cut in the context of an inefficient VAT system is likely to deliver mixed results at best.

4 min read

Seattle Officials Return with New Proposal for Taxing Employment

Seattle’s city council are again gearing up for an effort to increase taxes on the city’s largest employers, intended to generate revenue for cash assistance to low-income households impacted by the COVID-19 crisis, among other reasons.

4 min read

D.C. Council to Consider Tax Hike Despite Balanced Budget

Despite a balanced budget and and revenue shortfalls arising from the coronavirus crisis, the D.C. Council will consider proposals to raise income taxes to fund newly proposed spending projects.

5 min read

Inefficiencies Created by the Tax System’s Dependence on Economic Depreciation

One idea that would help the nation’s economic recovery during the coronavirus crisis would be moving to full expensing of capital investment. The depreciation debate might seem confusing, so the question at hand is: how, when, and by what amount can businesses recognize (or recover) the cost of a capital investment, like a piece of equipment or a new warehouse, on their income tax return?

6 min read

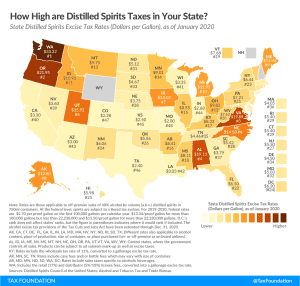

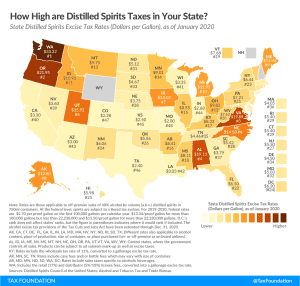

Colorado Tobacco Tax Bill Includes Positive Change

While it is understandable that lawmakers and organizers are worried about Colorado’s financial situation, they should remember that narrow taxes are volatile and disrupt markets. Excise taxes can play a role in state revenues even as policymakers appreciate that excise taxes are not viable long-term revenue tools for general spending priorities.

4 min read

New Jersey Considers Bonds Paid for by Statewide Property Tax

As New Jersey lawmakers grapple with reduced revenues due to the coronavirus pandemic, they have turned to an unusual solution: the issuance of bonds that would be repaid, if necessary, through temporarily higher sales and property taxes.

2 min read