Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

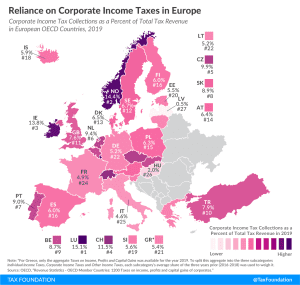

Despite declining corporate income tax rates over the last 30 years in Europe (and other parts of the world), average revenue from corporate income taxes as a share of total tax revenue has not changed significantly compared to 1990.

1 min read

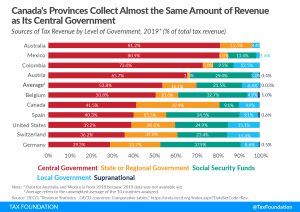

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

As the House Ways and Means Committee continues working on the latest round of fiscal relief amid the pandemic, one curious provision in the legislation is a tax hike on multinational companies. One section of the legislation would repeal a provision in current law that allows U.S. multinationals to choose to allocate their interest costs on a worldwide basis (more on that in a moment).

4 min read

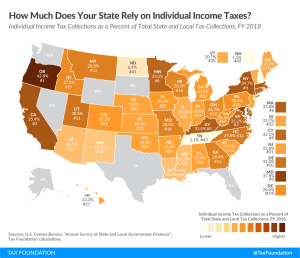

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus pandemic, as different tax types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue.

4 min read

The House Ways and Means Committee measures would further extend the relief measures created by the CARES Act and the Consolidated Appropriations Act of 2021, and would go further by significantly expanding existing tax credits and making changes to the international tax system.

7 min read

In addition to its economic impact on Maryland businesses and the likelihood of serious legal challenges, Maryland’s proposed digital advertising tax is incredibly vague on vital definitions, creating uncertainty about where revenue is sourced and when it is subject to the tax.

17 min read

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

House Ways and Means Democrats recently released a proposal to expand the child tax credit for one year as part of President Biden’s larger $1.9 trillion economic relief package.

5 min read

By failing to keep pace with modern consumption patterns, sales taxes have become less neutral, less equitable, and less economically efficient over time.

16 min read