All Related Articles

History of Attempted Changes to Step-Up in Basis Shows Perilous Road Ahead

As Congress considers President Biden’s proposal to tax unrealized capital gains at death, the history of previous efforts suggests it faces a perilous road ahead. Lawmakers must resolve tricky design and implementation details that derailed past attempts to change how capital gains are treated when assets are passed from one generation to the next.

4 min read

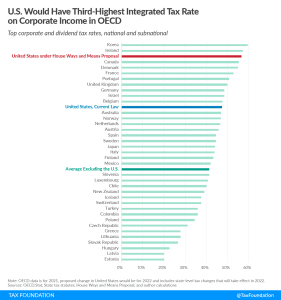

U.S. Corporate Income Faces Third-Highest Integrated Tax Rate in OECD Under Ways and Means Plan

Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

3 min read

Federal Judge Rules Against ARPA’s Tax Mandate

Kentucky and Tennessee won an important legal victory Friday when a federal court ruled that the American Rescue Plan Act (ARPA)’s restrictions on state fiscal autonomy were unconstitutional and enjoined (blocked) the enforcement of those provisions against both states.

7 min read

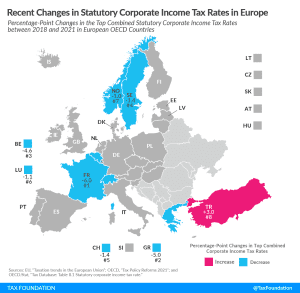

Choose Your Own Adventure: Global Minimum Tax Edition

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have surfaced in recent weeks, there are clear divides among various proposals.

5 min read

Latest White House Report Tells Incomplete Story on Average Tax Rates for Wealthy

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

Taxing Decisions, 2021: Minisode 1

We discuss where the reconciliation package on Capitol Hill stands and talk through recent Tax Foundation modeling, which found that the plan may not have the economic boost its proponents have claimed.

Reviewing Business Tax Expenditures: Credit Union Tax Exemption

Policymakers should carefully analyze tax expenditures before categorizing one as a loophole—some tax expenditures are important structural elements of the tax code while others are unsound.

14 min read

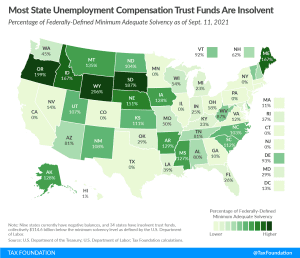

States Have $95 Billion to Restore their Unemployment Trust Funds—Why Aren’t They Using It?

Given the restrictions on the use of federal relief funding, and the significantly higher tax burdens on employment that will result if trust funds are not replenished, applying federal aid to these trust funds should be an urgent priority.

11 min read