Traveling for the Holidays? States Would Like the Gift of Taxes

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read

Michael J. Graetz is the Columbia Alumni Professor of Tax Law and a leading expert on national and international tax law.

5 min read

With the adoption of its new budget in mid-November, North Carolina has reinforced its position as a leader in pro-growth tax reform, becoming the 12th state to enact income tax rate reductions in 2021 alone.

7 min readLearn more about the House Build Back Better Act, including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals.

15 min read

Senior policy analyst Garrett Watson joins host Jesse Solis to discuss the Build Back Better Act’s prospects and what tax changes—ranging from the SALT deduction to the Child Tax Credit—could change in order to gain enough support for passage.

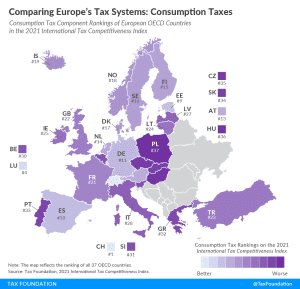

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

As lawmakers today look for ways to boost American industry and reduce costs for consumers, they should pay attention to the mountains of evidence that the Trump-Biden tariffs have harmed American consumers and businesses.

6 min read

Temporary tax relief measures, like refund checks or gas tax holidays, are not necessarily bad, and can be justified as ways to return excess revenues to taxpayers, but they often miss an opportunity to do better by taxpayers in the long run.

7 min read