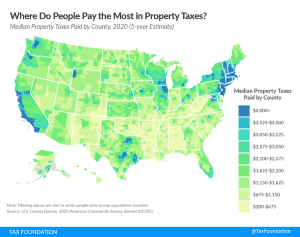

Property Taxes by State and County, 2022

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

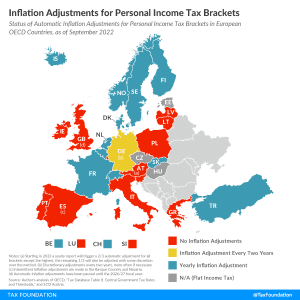

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

Will states consider student loan forgiveness a taxable event? In some states, the answer could be yes.

5 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

With continued concerns over inflation, individuals may be wondering how their tax bills will be impacted. Less than half of OECD countries in Europe automatically adjust income tax brackets for inflation every year.

3 min read

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read